Jim Greco sat in front of his computer at Jeffries Investment Bank headquarters in New York and thought about the futility of his bond trading job. He was about to pull up a file on his PC and then make a physical phone call to another institution to place an order for a bond transaction. Something needed to be done.

Unlike the stock market, the bond market doesn’t have a centralized system where traders can plainly see the fees involved in the trade. This means traders have to ask each bank, one by one, either by phone or electronically, what they are willing to sell a Treasury bond for.

It seems pretty archaic, but it’s the way the bond market operates for the most part right now.

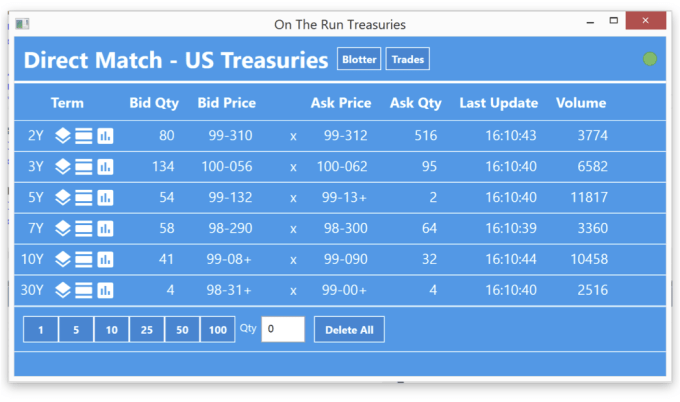

This gave Greco an idea that might seem rather simple: put the bond market online. Greco and his co-founder Galen Simmons created the Y Combinator-backed Direct Match, an online bond trading platform that centralizes that information so it can be as easy to trade bonds as it is to trade stocks.

For stocks there are exchanges like NASDAQ and NYSE where thousands of institutions congregate to trade with each other. For bonds, it’s completely different. There’s no centralized exchange. The bank makes money when the customer buys a bond based on the fees the bank sets.

“This creates perverse incentives in that the bank is actually trading against you on every single trade,” says Greco.

Direct Match doesn’t charge fees so that eliminates the incentive to charge against the consumer. Instead it seeks to provide market structure research and context around buying and selling of bonds. The overall goal, according to Greco, is to make the system more transparent and thus bring down the cost of these fees.

There is a trading network currently in existence that many of the larger financial institutions use called eSpeed. This is an electronic bond trading network that is part of the Nasdaq OMX Transactions Services business. However, it is expensive and not something available to many of the smaller and mid-tier banks and institutions.

Direct Match, on the other hand, intends to offer the platform for free. Greco says the open platform is intended to level the playing field and provide fee transparency for all bond transactions. That could also equalize the wide fee ranges as well.

However, that transparency is only available to a few institutions. Direct Match is currently testing the service in closed beta with about 20 firms. It plans to launch the platform to everyone in the latter half of 2015.