The U.K.’s first-to-market 4G/LTE network, EE, has today announced network expansion plans in a bid to stay ahead of the carrier competition — revealing plans to spend £1.5 billion over the next three years to beef up its high speed mobile network.

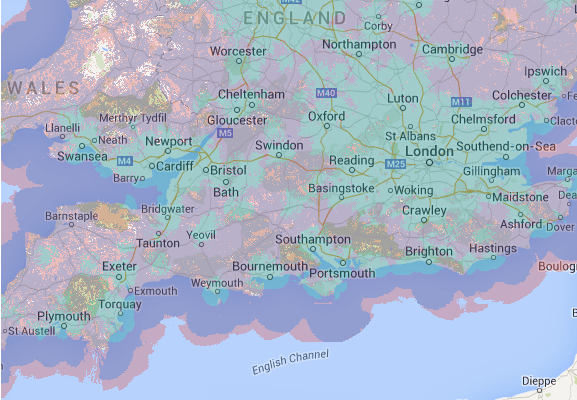

The aim is to expand its 4G network coverage from the current reach of more than 80 per cent of the U.K. population, to more than 99 per cent of the population — and 90 per cent of the U.K.’s geography — by 2017.

Improving its rural coverage is listed as a specific aim, with EE noting it plans to use Micro Network technology “to make phone calls and mobile data available in 1,500 communities that are not currently connected by either reliable mobile or high speed broadband”. And to deploy low frequency 800MHz spectrum across its rural network to expand its reach by more than 1,500 square miles.

It’s also planning to improve mobile coverage on roads (focused on voice services principally) and railways — with “specific 4G expansion to cover the country’s busiest train routes”.

The carrier was first to launch LTE in the U.K., back in October 2012, and was followed during the course of 2013 by 4G network launches from the other three U.K. mobile network operators: O2, Vodafone and Three. EE is evidently hoping to retain its 4G headstart by expanding the reach of the network. In its results for last year, it reported growing its 4G base to 7.7 million, which it said makes it Europe’s largest 4G operator.

It has also invested in upping its 4G network speeds since the 2012 launch — and has added a further commitment on that front now, to double 4G speeds for 90 per cent of the U.K. population by 2017, switching on data speeds of up to 60Mbps.

It says it will also roll out its highest speed and capacity 4G+ tech, which offers up to 150Mbps for those with compatible devices, to 20 U.K. cities by 2017.

In related news, earlier this month EE agreed to be acquired by U.K. fixed line incumbent telco and broadband provider BT — with a price-tag of £12.5 billion on the acquisition. The deal is expected to close in the first half of 2016, pending regulator and shareholder approval, so EE remains at the helm of its mobile business for now.

BT has said it plans to market its broadband, fixed line, and pay-TV services to EE customers. At the end of last month it also revealed its own investment plans for expanding the reach and capacity of its fixed line fibre broadband — setting out a plan to increase access to up to 500Mbps fibre broadband to a majority of the U.K. population by 2025.

If EE is pushing out higher capacity high speed cellular connectivity to more of the U.K. population it may ease the pressure on BT to upgrade its fixed line broadband network — while also giving the telco another high speed pipe to push services down.

BT has been routinely criticized for dragging its heels on upgrading its infrastructure from legacy copper to full fibre. The cost and effort of replacing in-the-ground broadband infrastructure positions mobile data as an easier to implement alternative, especially for harder to reach rural locations, even though cellular tech can’t offer the same futureproof promises as fixed-line fibre.

That said, also today, EE said it will be getting involved with development work around the next generation of cellular tech, 5G, which can support speeds of up to 1Gbps — working with the 5GIC at the University of Surrey and the E.U.’s Horizon 2020 ‘TWEETHER’ project at Lancaster University.

Commenting in a statement, EE’s principal network architect, Professor Andy Sutton, noted that 4G provides a “foundation” for 5G, and added: “We’re investing in 5G so that we can define the next step, and keep both us and the U.K. mobile industry one step ahead.”