Louis Beryl, the founder of the personal lending (and now student loan refinancing) business Earnest, knows a thing or three about student debt.

When Beryl was trying to drum up loans for grad school, he’d run into a problem. Nobody would lend to him — and when they did, the rates were extortionate. In the end, Beryl wound up going to a bank of last resort: his mother (who refinanced her home to pay for the loans).

“When I wasn’t getting the loans, I was like, ‘What the fuck?'” says Beryl. “And when my rates were in the teens, I was like ‘What the fuck?'” again.

Talk to almost any university graduate, and you’ll hear horror stories about the nation’s looming debt crisis built on the backs of higher education. It’s a source of macro-economic concern, with roughly $1.2 trillion in student debt on the books at various lenders and now Earnest, which began as a personal lending company, is stepping into the breach.

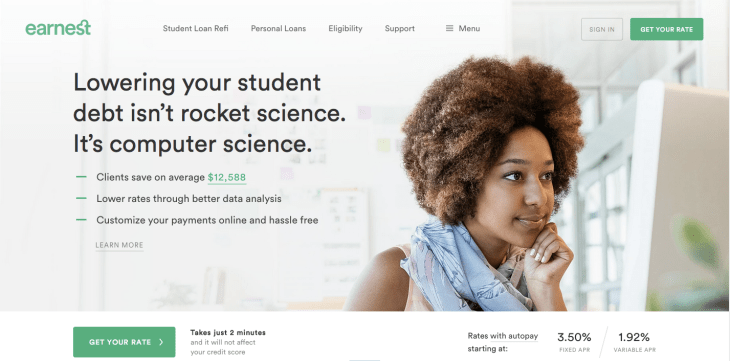

The company has launched a new student loan refinancing service offering loans with annual payment rates as low as 1.9%. The online service is also instantly flexible, with options to change the rates of repayment at automatically reduced rates, based on a user’s decisions. The company estimates that they can save college students roughly $12,500 on average, compared with traditional refinancing options.

The company has launched a new student loan refinancing service offering loans with annual payment rates as low as 1.9%. The online service is also instantly flexible, with options to change the rates of repayment at automatically reduced rates, based on a user’s decisions. The company estimates that they can save college students roughly $12,500 on average, compared with traditional refinancing options.

The technology has attracted attention from a bevy of big swinging investors, and has recently closed a $17 million Series A round of funding as it builds out its new offering.

The new financing was led by previous investor Maveron, and included participation from Andreessen Horowitz, Atlas Venture, Collaborative Fund, First Round Capital and other investors.

Akin to other new entrants in the credit scoring and lending market, Earnest uses ever-popular big data technology to determine credit scores based on what the company calls a customer’s long-term financial profile. Big factors in determining these lower rates are retirement accounts, savings, and education.

Indeed companies like SoFi and CommonBond have raised significant amounts of capital based on their ability to determine better rates for student and graduate borrowers as well.

Features (which honestly every lender should provide to their borrowers) include an ability to set the exact payment amount or repayment length along with the opportunity to change the payment amount based on changes in income status over time; borrowers can also skip payments once a year; switch between variable and fixed rates at no charge; split payments into twice a month

Earnest launched in September 2013 with its personal loan product that’s typically tapped for life events like weddings, childbirth, or personal educational growth. The company actually has partnerships with coding academy’s and professional training startups like General Assembly,

The San Francisco-based startup has 35 employees on staff, working out of the old Zenefits office on Portrero Hill, and will use some of the money to move into a new location.

The company’s foray into student loan refinancing is just the first step in its mission to penetrate every major lending market. Beryl says the company will look to provide auto loans and mortgages, as well.

The average loan size for the company’s student loan refinancing program is between $55,000 and $75,000 in its limited beta.

So far, in the company’s traditional personal lending business, there haven’t been any defaults or delinquent payments. Earnest has become the largest lender to participants in Coding Bootcamp, and has partnered with General Assembly, Tradecraft, Coding Dojo, and Galvanize.

Loans on the traditional side of the business tend to be smaller, with a typical loan coming in at around $12,000 to $14,000, rather than the tens of thousands available for student loan refinancing, says Beryl.

A scion of suburban New York, Beryl says that Earnest’s lending platform will never be used for small business owners, because the market is so different. Rather, he calls Earnest’s mission “loans for living life.”