Cap tables are not just broken, they’re stuck on Excel spreadsheets and archaic paper systems. This leaves a lot of room for human entry errors and a gaping lack of information to the shareholders. But what can be done to fix the problem?

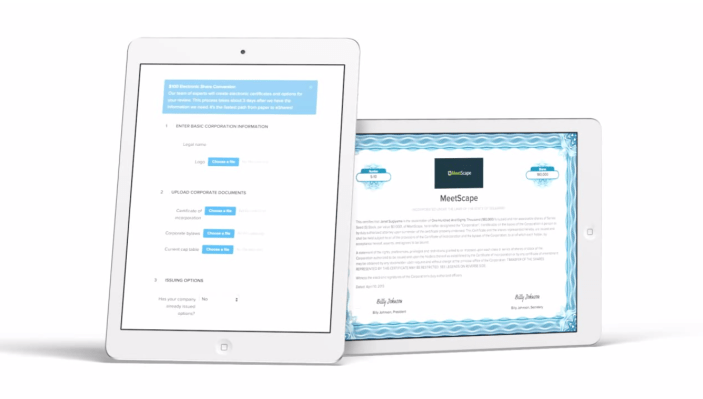

Suggestions include everything from documents shared in the cloud to adding records to the blockchain. Henry Ward, founder of eShares, an online record-keeping platform for privately held companies, says the solution is to do like public companies already do – go digital.

Cap tables, for those unfamiliar, are a record of all the shareholders in a company. If you are a publicly traded company, the SEC requires transparency for all shareholders via the Depository Trust Corporation set up in the 1970’s. This put a stop to the physical exchange of stock certificates and provided security and accountability for the rising amounts of paperwork that were starting to crop up in the U.S. financial industry.

“Admittedly, I am surprised that the current system has worked for this long. There is something paradoxical about funding companies building virtual reality, autonomous drones, and Bitcoin markets, using Excel and paper certificates.” Henry Ward

The problem is humans are human, mistakes are made and certificates get lost. “Say you give me $1000 for my startup and I give you 100 shares. We issue the paper document and then that gets recorded into Excel. But then something might’ve converted wrong or the paper gets lost somehow,” says Ward, the founder of eShares, a startup attempting to bring privately held companies into the 21st Century with a digital record-keeping platform for startup shareholders.

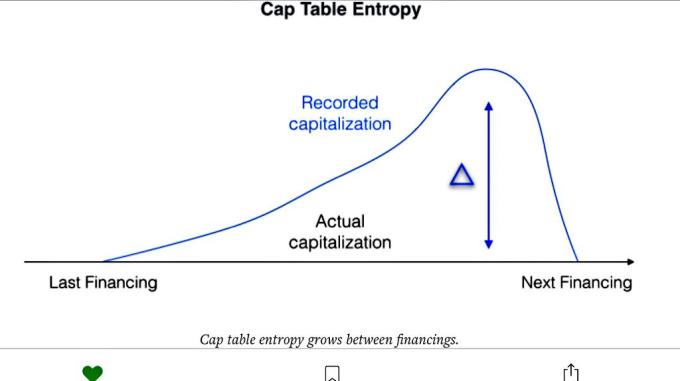

Ward’s “Broken cap tables” post on Medium hit a nerve with many in the startup world over the weekend. He says he thought he would reach maybe 7 people with his January 2nd post that detailed four major issues with the current privately held company cap table system:

- Most cap tables are wrong

- Most investors don’t track their shares

- Note holders are often forgotten

- Employees suffer most

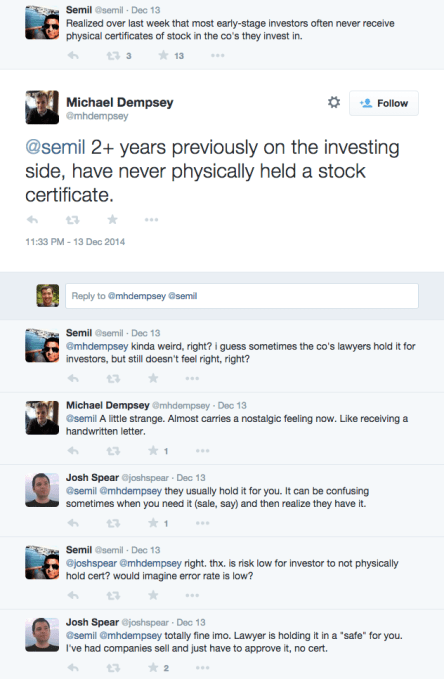

The Twittersphere caught wind of the post and it spawned dozens of conversations within the Silicon Valley community:

Angel investor Andy Palmer puts it bluntly in a post on cap tables for Koa Lab, “So here you are: because some inexperienced junior paralegal screwed up certificate administration, the employee who worked hard, did your job, sacrificed as required to make the company successful and produced results, now has to reach into their pocket and pay $15K+ for a bond that should have been completely unnecessary,” Palmer writes.

On top of this, investors and employees of the company often don’t know what they own. They know the number of shares but not the percentage. The certificate doesn’t tell you this. But then they may not even get a physical paper certificate saying they own a certain amount of stock, either. That presents a particular problem if the stock splits.

Some ventures try to solve for double-entry mistakes by sharing the spreadsheet in Google docs or adding the documents to Dropbox. Law and venture firms may even keep the records on their own internal electronic system, but that still doesn’t lend to full transparency to the shareholders or ensure the document is accurate.

As Union Square Ventures, an investor in eShares, noted in its latest blog entry:

“At the end of each quarter, we have the fun job of nudging the busy management teams of our portfolio companies to provide a current cap table so we in turn can accurately report our ownership positions to our limited partners. The whole process feels like snail mail and is prone to error. Not to mention the process of collecting and storing stock certificates in a third party vault, even though no one except our funds could really offer these outmoded pieces of paper as evidence of a legally valid ownership position.”

Ward doesn’t know how wide-spread the problem is but says it came up enough anecdotally that he decided to do something about it. His startup, eShares, attempts to take the same rules applied to publicly held companies and apply that model to private ventures.

The platform launched in beta in the spring of 2013 and shortly after gathered $1.8 in seed to test the product in the VC market. It quietly raised $7 million in Series A in November, led by Union Square Ventures. Additional funding came from Spark Capital, Subtraction Capital, and angel investor Andy Palmer.

Ward says the seed round was for proof of product. This last round should help the company reach beyond Silicon Valley and into the main stream mom and pop entrepreneurs market. “The first thing people think about when starting a business is incorporating. I want registering with eShares to be the second thing people think about.”

Matthew Joseph Martin, founder of Muslim financing outfit Blossom Finance mentioned in a follow-up Medium post to Ward’s that venture capitalist Tim Draper requires all his investments register with eShares.

Although Ward’s post might have struck a nerve, it’s also worth noting that it’s self-serving. He might not know how widespread the broken cap table issue is, but his solution is to move equity management to a digital platform. You know, to something like eShares.

It’s surprising that startups have been working within such an archaic paper system for this long. This is Silicon Valley, arguably the most innovation-rich and technologically forward area in the world.

“Admittedly, I am surprised that the current system has worked for this long,” Ward writes. “There is something paradoxical about funding companies building virtual reality, autonomous drones, and Bitcoin markets, using Excel and paper certificates.”

Is it the one electronic system to rule all cap tables? Ward isn’t sure eShares is the answer, but asserts it’s at least an answer:

“It is easy to describe the problem but harder to predict how it will be solved. However, it is safe to say the days of Excel and paper stock certificates are numbered. It can’t scale with the growth of investment activity. The system will break. The question is what will replace it and when. Time will tell. Hopefully eShares will be part of the answer. But even if it isn’t us, somebody else will fix it. They just have to.”