Lending startups are en vogue this year, with LendingClub and OnDeck planting the flag for the industry in public markets (and offering healthy returns to investors). But there’s a crop of other lenders and service providers waiting in the wings, like Biz2Credit, which just received a $250 million commitment from investment firm Direct Lending Investments.

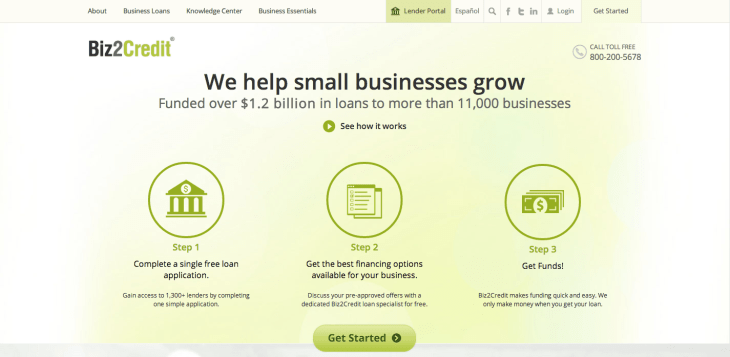

Unlike OnDeck, which lends directly to small businesses, Biz2Credit acts as a service provider, vetting the viability of potential borrowers and then connecting them with lenders, like Direct Lending Investments, who provide the capital for the loans.

Once the loans are made, Biz2Credit handles all of the follow-up.

Founded by brothers Rohit and Ramit Arora, who immigrated to New York from India in 2003 and 2001, respectively, Biz2Credit proves that there are still opportunities for first-generation entrepreneurs.

According to Ramit, the brothers launched their business because of the things they saw first-hand among entrepreneurs trying to get started in the U.S. — men and women with little or no credit history or access to traditional sources of capital.

“We started a marketplace peer-to-peer lending platform where we originate everything through our platform. Institutional funds come in and buy the loans and we underwrite them and service them on an end-to-end basis,” Ramit explains.

The company has a proprietary scorecard for issuing loans and collects reams of data on lenders across the country. That technology and analytics platform has led to some of the lowest default rates in the industry. Only 0.7 percent of the borrowers on the company’s platform have defaulted on loans.

Loans range between $25,000 and $500,000, which Arora calls the sweet spot in which most banks won’t lend.

Despite their reticence, these borrowers represent a solid investment, Ramit says. Roughly 70 percent of the businesses receiving mony on the platform have been in business for over three years and have more than $1 million in revenue.

Buyers of loans on the Biz2Credit marketplace include Direct Lending Investments (the largest investor on the marketplace, with $65 million in capital commitments already). Banks, which typically won’t address these customers directly, will provide cash to loan through the platform under their SBA portfolios. Union Bank, TD Bank, and other mid-tier regional banks have made loans through Biz2Credit, Arora says.

Borrowers range from warehouse operators to small retailers like restaurants and service businesses like hotels and motels.

The company expects to have roughly $80 million in revenue in 2015 and is looking to have an initial public offering by 2016.

Biz2Credit has 150 employees across offices in Delhi, New York, San Francisco and St. Louis and is backed by Nexus Venture Partners, a Menlo Park, Calif., and Mumbai-based investment firm.

“Over the last 15 years, banks have all but abandoned the small and midsize companies across the country in need of financing. Even when these loans are made by banks, it can take months for the funding to come through, but business owners often need more immediate solutions,” said Direct Lending Investments founder Brendan Ross, in a statement.