Fresh from making its first investment in India last month, News Corp has now completed its first acquisition in the country, buying financial planning service BigDecisions.com as Next Big What first reported.

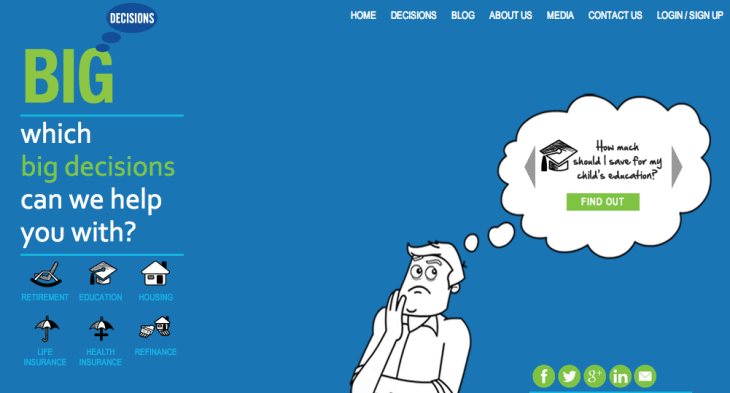

The service is designed to be a one-stop-shop that uses data and algorithms to help consumers in India make better financial decisions, for example related to retirement, insurance, education and home ownership.

News Corp did not provide a price for the deal, which includes parent company FinDirect Services and follows its $30 million investment in real estate service PropTiger. In a statement that is indicative of News Corp’s startup focus in India, chief executive Robert Thomson said both deals are about using the power of data to help improve purchasing and financial decisions.

“Our latest investment builds on our abiding belief that a digital India needs more trusted, reliable and independent data. BigDecisions.com will help Indians make the most important decisions by using accurate information tailored to their personal needs,” Thomson said.

BigDecisions.com was founded in 2013 and is based in Mumbai. It claims to have assisted 40,000 users’ financial decisions to date.

A News Corp announcement explained that co-founders Manish Shah and Gaurav Roy will lead a “significant expansion” of the product in partnership with its team in India.

This year has been a hugely significant one for startups in India. Facebook, Google and Yahoo each acquired startups from the country, while Flipkart is one of three major e-commerce firms to net significant amounts of capital from investors.

Flipkart raised nearly $2 billion in fresh capital this year — including a $700 million round this weekend — and that money has begun to trickle down as its founders have invested in multiple projects as angels, a move that will help accelerate the ecosystem.

SoftBank also entered the market late this year, bringing with it yet more attention and boatloads of money. The Japanese telecom firm made a series of big investments — leading a $210 million round for Uber rival Ola, Snapdeal’s $627 million round, and a $90 million investment in Housing.com — as part of a promise to put as much as $10 billion into young Indian businesses over the coming years.