Perhaps riding the wave of U.S.-based Lending Club’s recent $5.4 billion IPO, the UK’s Lendable, which also offers a peer-to-peer lending platform for personal loans, has raised a £2.5 million seed round from a decent group of European angel investors with plenty of fintech experience.

The young startup’s backers now include all three partners at London VC Passion Capital — Eileen Burbidge, Robert Dighero, and Stefan Glaenzer — each of whom invested on an individual basis. That’s because Passion Capital’s ‘Enterprise Capital Fund’ (ECF) structure, which means it counts the UK Government as an LP, prohibits it from investing in lending.

However, I’m told that the three partners were still convinced enough by Lendable’s potential to become big that they chose to put their own money into the company anyway.

Noteworthy also is that, amongst many other investments, Glaenzer is an early backer of German fintech company Kreditech, which helps to automate credit scores based on Big Data.

In addition, Will Kirby, an early investor in Market Invoice (which itself just picked up £5 million in new funding), also participated, as did Adam Knight, the former managing director Glencore-Credit Suisse and current executive chairman of the London-based Bitcoin exchange Coinfloor.

Now of course, P2P lending startups for personal loans isn’t a new phenomenon, not least in the UK where Zopa was a very early mover in the space and more recently counts RateSetter and Lending Works as competitors.

At the start of this year, Zopa added $25 million in new funding to its balance sheet, and now totals a hefty $56.6 million in VC to date. The same month, Lending Works disclosed £3.5 million in funding pre-launch. More evidence P2P lending and London fintech remains hot.

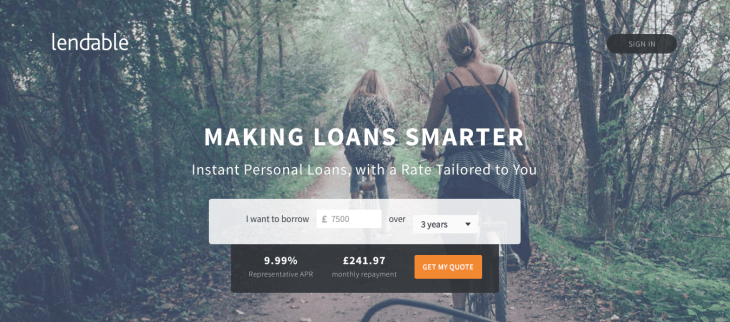

So, how does Lendable plan to compete? Like all P2P lending startups, the basic premise is that by matching investors with borrowers, thus bypassing the banks and other traditional loan companies, both parties get a better interest rate.

So far, so me-too.

However, the company thinks it’s spotted a gap in the market, backed up by its credit scoring algorithms that give borrowers an instant personalised rate based on filling out a speedy and short application form, while at the same time enabling more sophisticated investors to take a chance on borrowers who don’t have a “perfect” credit score, in return for a potentially larger interest rate.

Here’s how Lendable co-founder and CEO Martin Kissinger explains it:

The UK’s established P2P platforms for personal loans are all focused on creating a safe investment for retail savers. Therefore, they can only fund borrowers with the highest credit scores, and long, spotless credit histories. But 40 per cent of borrowers in the £200 billion a year UK consumer credit market are “near-prime” — their credit histories aren’t perfect, but close enough. At the same time, no platform in the UK creates better returns for institutional investors who are comfortable with credit risk.

Thus, says Kissinger, who previously consulted for Rocket Internet’s first fintech venture, Lendico, as the German startup factory’s Global Venture Developer, Lendable’s platform connects the two sides of the market to bring “the efficiency of the P2P model to the mainstream.”