The lending space couldn’t be hotter, with folks like Lending Club set to IPO, and new entrants launching every day.

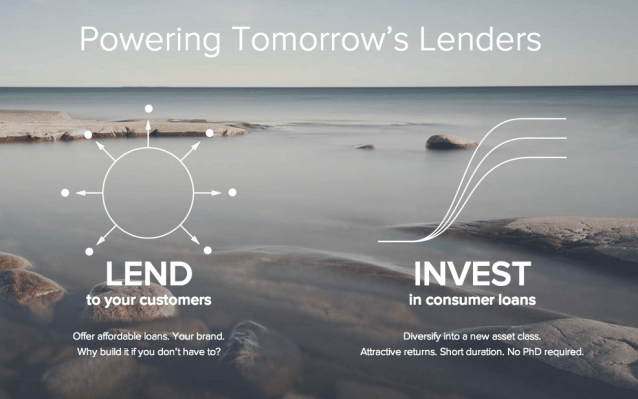

One of these new competitors just raised $16 million to let brands become the lenders of the future, offering a “Lending as a Service” (LaaS) platform. Meet Insikt.

The San Francisco-based lender will provide software that allows brands to offer small loans to their consumers, trusting Insikt to handle the meticulous details of actually providing the loans. These brands can range from retailers and merchants to actual banks, who are often limited to a small window of financing.

All loans are put on Insikt’s balance sheet for the first few months of their existence, powered by capital from Capital One and Atalaya Capital Management, among others. After each brand has its own portfolio, the entirety of that brand’s investments will be pooled together and issued as bonds to investors.

This allows them to diversify where their money is going, while allowing consumers with low FICO scores (or no FICO score at all) to get an installment plan application at the PoS.

In other words, Insikt is playing on both sides. The platform offers investors the opportunity to power loans for brands, which will in turn have technology that provides customers a lending option at PoS.

Revolution Ventures provided the capital for Insikt’s $16 million round of funding, dedicated to power growth for the company, but big financial firms have also provided upwards of $70 million in debt into the company to juice its lending business.

To learn more about Insikt, head over here.