Financial analysts matter. That’s why you often hear them asking questions at the end of earnings calls, when the CEOs of public companies try to avoid answering them directly. They research, analyze, and make recommendations that the regular person can follow.

Too bad they are often so damn wrong.

Tracour, co-founded by Brad Sams (Sams is a well-known technology writer, and generally decent human that I have known professionally for some time) aims to vet analyst recommendations to help people avoid lemons. Tracour launched into open beta this morning.

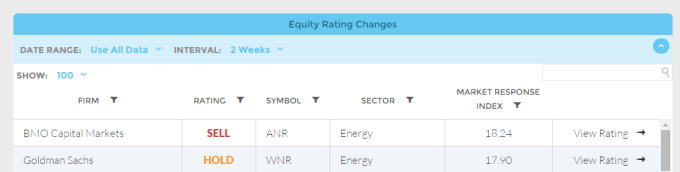

The company’s product takes in millions of data points, tracks analyst pronouncements, and then uses a proprietary algorithm to grade them. The company applies what it calls its Market Response Index, or MRI, to see how a stock performs after a particular ranking from an equity guru.

Does it go up or down, essentially. You can track that over several time periods. My personal favorite is using Tracour to check which equity advisers manage to the be most wrong on a one-day basis. They say the company is a buy, or a sell, and the market immediately moves in the opposite direction. Perhaps a little silly given the time frame, but certainly fun.

Sams, who founded the company with its CTO Braeden Petruk, gave me a tour of Tracour, showing off a number of its machine-curated “automated selection strategies” at work. The company runs more than 20,000, tracking different investment methods based on the data it works with. According to Sams, the best of these strategies earn more than 1 percent per day. The company therefore, using its algorithms, can so far make correct inferences about the coming performance of stocks based on tracking analyst recommendations, and the historical performance of those picks over time.

I was curious why the company doesn’t just take its own advice, and make money using its data. Sams told TechCrunch that the “short answer is it takes lots of money to make lots more money, even at 1 [percent] per day.” The company’s leadership “do use [Tracour] on a personal level,” but he noted that they don’t have the capital on hand to quickly grow it into personal fortunes.

I was initially attracted to the idea behind Tracour after seeing stocks gyrate following new analyst recommendations. Shares of smaller companies could skyrocket, or dip, after one or several analysts made their research known. It surprised me — why did their words matter?

Tracour can lead to some funny moments. Here’s the company’s normal view, rating recent recommendations on a two-week interval:

As you can see, the MRI indicates that when BMO gets it pretty wrong on AMIR. The positive MRI states that, at this time interval, sell ratings from that group about that stock are followed by its stock rising. A lot, given the strength of the MRI indicator.

Of course, results change over longer, or shorter periods of time, but you can tune that to your own trading range.

Tracour is now a day old. I’m curious to see what the real financial kids can do with it. If the service can prove that some analysts don’t have clothes, then more power to it. If it does become popular, Tracour could shift trading patterns. For now it’s open and free, and if you like the stock market, it’s worth playing with.

FEATURED IMAGE: NATHANIEL ZUMBACH/FLICKR UNDER A CC BY 2.0 LICENSE (IMAGE HAS BEEN MODIFIED)