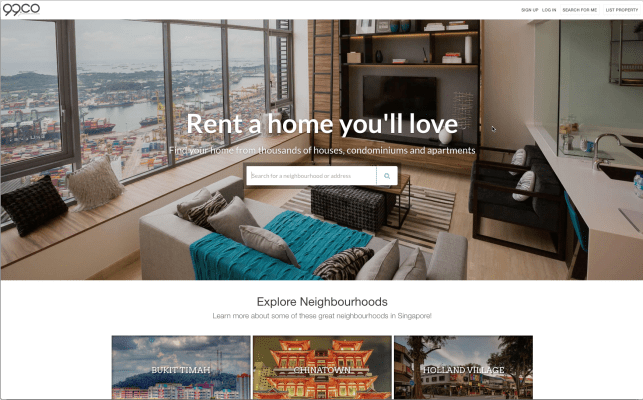

Despite having a population of just 5.4 million, Singapore is one of the top 10 real estate markets in the world. New startup 99.co wants to grab a slice of the pie with a site that it says makes listings more transparent and navigable for potential renters and buyers.

99.co soft-launched last week, but had its beta launch in May. Since then, 1,200 agents have signed up, listing 11,000 properties. The startup, founded by serial entrepreneur Darius Cheung, has raised $560,000 in seed funding from Fenox Venture Capital, 500 Startups, East Ventures, and Golden Gate Ventures.

There are already two leading real estate listing sites in Singapore, PropertyGuru and iProperty, but Cheung says 99.co differentiates by taking the focus away from sponsored listings, which real estate agents pay extra for, and making search results more relevant to users with its ListRank algorithm.

Founder Cheung already has a proven track record. In 2010, Cheung sold his startup tenCube, which made security software for mobile platforms, to McAfee in a deal that was reportedly worth $25 million. Since then, Cheung’s other projects have included BillPin, a mobile app that lets friends split restaurant bills and other expenses, which TechCrunch profiled in February 2013.

Bill-splitting apps and real estate listings may seem very different, but the ideas for both came from problems Cheung tackled in his personal life.

“Last year about this time, I was searching for a new apartment. I’d been renting in Singapore for 20 years, but this was the first time I searched for myself, because I used to outsource the work to my roommates. My roommate left, and I had to search for myself. I found it was really painful and as a software engineer, I didn’t understand why there wasn’t a solution,” he says.

By using a business model that focuses on premium listings, sites like PropertyGuru and iProperty “encourage behavior where no one really cares about the quality of the search results,” claims Cheung.

He says that 99.co’s ListRank makes search results more relevant to the needs of individual users by focusing on 30 data points from listings. These include listing quality, which looks at how complete and specific the information provided is, as well whether or not agents have copied-and-pasted the same text for different ads. ListRank also examines user behavior. For example, if someone spends a lot of time looking at condos with a certain kind of floor plan (like a large living room) or within a specific price range, the search engine will start to find and return similar listings.

As the site grows, agent ratings will become an important factor, too, says Cheung.

For the next six to twelve months, 99.co will stay focused on Singapore. Despite the relatively small size of the market, Cheung believes that it has plenty of growth potential for a startup in the real estate sector.

Late last year, PwC said that Singapore’s ranking fell to seventh place for 2014 from third-place in 2013 due to too much inventory in some property sectors. But, it added that “the city holds considerable investment and development appeal, due to its vibrant economic growth and strong emphasis on community livability.”

In addition, Cheung notes that iProperty, which is listed on the Australian Stock Exchange, currently has a market cap of $371 million dollars, pointing to 99.co’s potential worth if it manages to succeed against its well-established competitors.

In terms of monetization, Cheung says that 99.co, which is currently free to use, will adopt a similar revenue model as its competitors, by charging real estate agents for listings. But it will take a different approach, perhaps with a flat subscription fee. “Every agent pays the same price to be part of the board listings and there is no way to influence search results based on that pay model,” he says.