Fyndiq, a startup based out of Sweden that has built an online marketplace for merchants and brands to sell bargain-basement and end-of-run goods for as much as 70% off the original retail price, has raised $20 million — funding that it will be using to take its already-profitable business to new markets, with an eye to expanding specifically in the UK, Germany and Poland first.

The funding is notable in that it was led by one of the more prominent VCs based in the Nordics, Northzone, which was an early investor in Spotify, as well as Videoplaza (sold recently to Ooyala), mobile payments company iZettle, Trustpilot and many others. The other investor in this round, Industrifonden, is a VC backed by the Swedish government that invests in startups from the country to help scale them internationally. Before this, Fyndiq had raised about $6 million, CEO and co-founder Dinesh Nayar tells me, from angels that include former SAS CEO Jan Carlzon.

Fyndiq’s valuation is not being disclosed in this round, but Nayar says that he and the other four co-founders — Micael Widell, Fredrik Norberg, David Brudö and Dan Nilsson — remain the majority shareholders.

Amazon has made its name in e-commerce by offering a one-stop online shop both to buy goods and digital services from third parties as well as Amazon itself, but there have been a number of others who are pushing pure-marketplace models, where the focus is on third-party retailers with no stock belonging to the store/platform itself.

While eBay and Alibaba are both expanding their marketplace services across international borders, Fyndiq is part of the new wave of sites that have emerged as national leaders that are also building on this idea. (Another is Snapdeal in India, which last month announced a mammoth round of $627 million led by Softbank to expand its business.)

“We will never carry own stock,” Nayar tells me. “We are a sales channel for merchants and merchants are our partners. Amazon is today everything for everyone and we believe that there is always a position/niche to take against a player like that. While operating a marketplace model, Fyndiq is the bargain superstore for bargain hunters. This is our niche.”

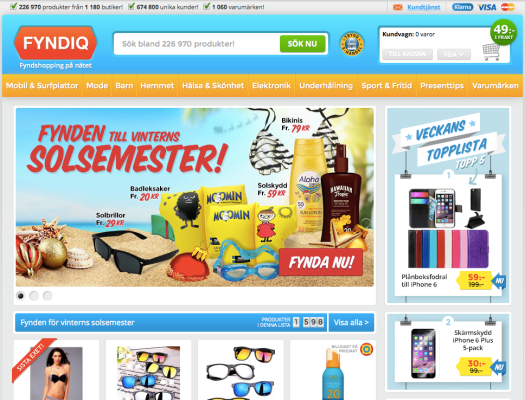

Fyndiq’s speciality is that it focuses specifically trying to shift on slow-selling products, those at the end of a sales run, or simply over produced items, which it sells for a lower price. (One item that caught my eye: a table-top, terracotta-domed pizza maker that lets everyone at the table can make their own. The pizza version of a fondue maker, I guess you could say.)

Currently, Fyndiq only takes a fee — 5% currently — on items that are sold. That is smart: letting merchants list items free of charge encourages a large range of stock on the site. There are some 230,000 products on offer on the site right now and Nayar’s main focus now is to add much more volume both in catalogue and transactions. Fyndiq then provides all the logistical underpinning to get that item delivered to the buyer.

After what was a slow start in 2009 — this profile in Sweden’s Dagens Industri describes their early days living out of a mobile home in the early days, visiting and shopping themselves at brick-and-mortar bargain basement stores for market research — the formula now seems to be working. After making only $1 million in 2011, Fyndiq posted $17 million in sales in their last financial accounts for the year that ended April 2013, and they expect to have sales of $27 million in the next year. And while they posted a loss of $2.3 million last year, this year they expect to swing into the black.

And yet, it still remains to be seen whether Fyndiq will be able to keep its own margins and focus as it grows bigger. Companies like Fab found it very hard, for example, to scale the marketplace model and ended up retreating from it and pivoting to selling its own, reduced number of goods.

And of course companies like Amazon could easily decide to become more aggressive in their own bargain basement offerings. The company already owns Woot, which also played on the idea of offering new goods at big reductions, with a weekly “bag of crap” playing on the idea that not all these items have exactly been in high demand. Amazon now also seems to be making a bit more noise around its Warehouse Deals — where it sells opened or damaged-packaging items for deep discounts.