While PayPal continues to work out its frenemy relationship with Apple, and figure out how it will chart its life as a company separate from its owner eBay, its mobile and developer-friendly payments subsidiary Braintree, acquired in 2013 for $800 million, is launching a new service that will let merchants sign up to the platform with only an email address, URL and short company description. It’s also extending its offer to Europe of offering the first $50,000 of transactions on the platform (in a local currency equivalent) free of any commission fees.

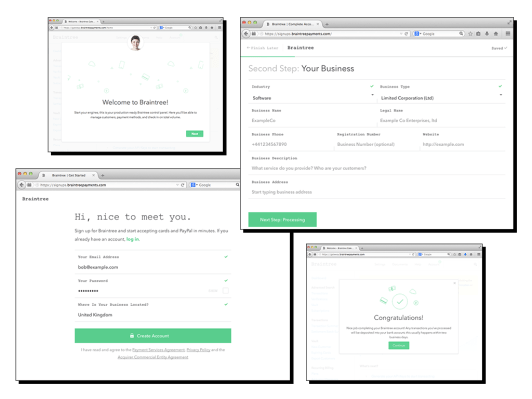

The ability to use so little information is a big change from how merchants have set up payments systems in the past, particularly in Europe, where many banks require paper-based documentation to approve accounts. Here, Ready says that Braintree uses a combination of algorithms and a human smarts to research a company based on those three pieces of information to determine whether a company is a legit merchant to add to its platform.

There is a two-fold intention behind instant payments sign ups: first, to make it more seamless for merchants to sign up to PayPal’s services to bring more transactions to its platform; and second, to get more people to sign up for its new v.zero SDK, which was first launched in July and is the first major product released by Braintree post-eBay acquisition.

Interestingly, the new instant payments sign-up is being debuted not in the U.S. but in Europe. This follows a pattern at PayPal and eBay to try out services on this side of the pond before expanding elsewhere. Braintree, however, has yet to launch Venmo outside of the U.S.

“We’re launching it first in Europe, but it was always our premise that we would do this globally,” Braintree’s CEO Bill Ready said in an interview with TechCrunch from Dublin. “Often you see this pattern of companies building something in the U.S. and then taking it international. We want to make sure that we can build products that can start internationally, and eventually we will also take it to the U.S.”

Braintree’s instant payments sign-up follows on from a number of other products launched by the company that have looked to disrupt the payments hegemony by creating simple technical innovations. These have also included drop-in checkout forms and “soon” a way to offer one-touch mobile payments with PayPal — no date specified yet for when this will launch, however.

PayPal now has 157 million active customers, and within that Braintree says it has nearly tripled the reach of its platform, with 85.7 million cards on file for single-click/repeat purchase as of Q3 2014 (up 22.4% from Q2). But it’s noticeably absent as a partner for one of the biggest pieces of news in mobile payments, the launch of Apple Pay.

Ready says that this isn’t exactly the case, at least where Braintree is concerned.

“Nine or 10 of the companies Apple announced as launch partners for Apple Pay use Braintree in their payments systems,” he says. “We are working with Apple Pay.” Whether that will see Apple ever give over the front-end of the payments system — control of the payment button — over to PayPal is the question. This is what Samsung has done in its integration with the payments company, seen by some as the reason that the iPhone maker has kept PayPal at some arms length.

Ready disagrees and says that it’s more because of the sheer size of PayPal — it’s significantly more difficult to forge partnerships when the partners are large but there is still a lot of potential there for both companies, either together or separately.

“About 10% of transactions today are e-commerce transactions,” he said, “and mobile is only 10% of those e-commerce transactions. That means mobile payments are just 1% of all commerce transactions. There is a lot of room to grow and to work togehter, even if the negotiations with the largest players are more complex.”