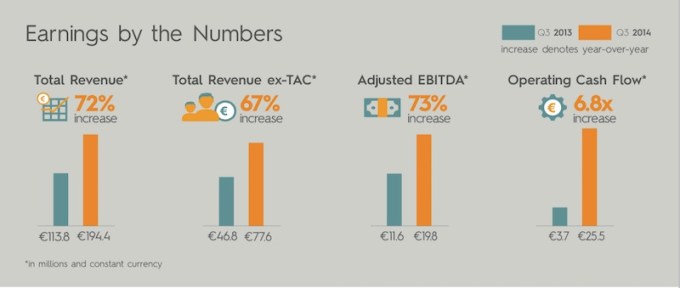

Ad tech company Criteo posted a strong earnings report today, with revenue of €194.4 million (excluding traffic acquisition costs it was €77.6 million) and earnings per share of €0.18.

That comes in well ahead of analyst estimates of €72.7 million in revenue (excluding traffic costs) and €0.08 EPS. It also shows revenue growth of 70.9 percent year-over-year, or 65.8 ex-TAC.

Criteo also reported net income of €11.5 million, up from €3.0 million a year ago.

The company has actually beaten estimates in the past but has still seen its stock fall — some of that may have been investors moving away from ad tech as a whole. This time, however, the company’s numbers may have been good enough to overcome that general skepticism. As of 4:59pm Eastern, Criteo’s stock is up 16 percent in after hours trading.

Arguing that there are “a lot of myths in the market,” co-founder and CEO JB Rudelle acknowledged that the growth of many ad tech companies has slowed. What sets Criteo apart, he told me, is the fact that “for us, the cornerstone is not just our financial performance. We are focused on the performance marketing world” — namely, ads that are priced based on measurable results, not just eyeballs.

The Paris-founded company also says that revenue grew 97 percent (at constant currency) year-over-year in the Americas, up from 78 percent last quarter, so growth here is accelerating. The company added 450 new clients in the past quarter, bringing the total to 6,581. And it pointed out that 74 percent of clients are using Criteo’s multi-screen advertising products.