In hindsight, it was one of the more controversial decisions the city has made in years.

Back in 2011, on a quiet threat that Twitter would leave the city and decamp for nearby Brisbane or South San Francisco, the city decided to offer a temporary exemption on it 1.5 percent payroll tax to entice companies to move into a set of very specific buildings in Mid-Market. For decades, that area had a much higher commercial vacancy rate than nearby SOMA or the Financial District after the city ripped up the streets to create BART. It was also bordered by the Tenderloin, which houses and serves much of the city’s low-income population in single-room occupancy hotels and a net of non-profit services.

The bet was that if you could secure one major tenant, you could trigger a cluster of tech companies to move into the area. You have to keep in mind that the regional and national economy was in a very different state then, so the city government was focused on job creation as opposed to housing.

A handful of companies took it — notably Twitter — and the program has since become a punching bag for the far left, who say the city shouldn’t have offered tax breaks to multi-billion dollar companies. In any case, the payroll tax was totally scrapped not long after and the city is shifting towards taxing gross revenues by the end of this decade.

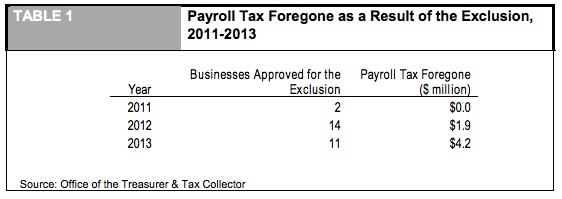

Today, the city controller finally put a report out on its economic impact three years later. It found that 15 companies used the exclusion last year, cutting their payroll tax costs by $4.2 million.

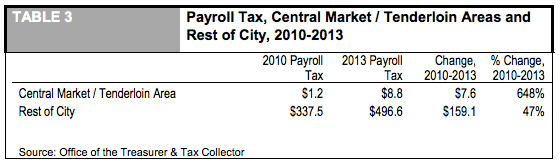

However, businesses that moved to the area paid $7.6 million more in payroll tax last year, than they did in 2010. Some of this, of course, is due to an overall economic recovery.

But the controller’s office found that the area generated $7.1 million more in payroll tax revenue than it would have if it had grown at the same rate as the rest of the city. This number counts companies that didn’t take the tax exclusion like Uber and Square, which moved into an adjacent building on Market Street. That $7.1 million figure represents 3,000 new jobs. As you can see below, that’s a sevenfold change from three years before, compared to a roughly 50 percent increase for the rest of the city.

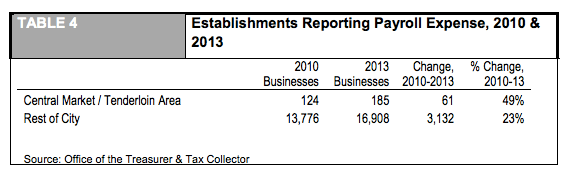

It also increased the number of businesses in the area, with 61 more last year than in 2010. This was nearly double the rate that the entire city added businesses.

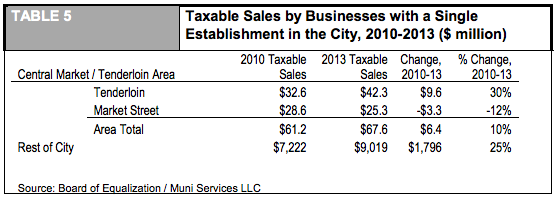

Taxable sales are still growing slowly, however. There was a 10 percent increase in the area, compared to a 25 percent increase in the rest of the city. I think this would reflect the concern that several of these companies like Twitter are essentially closed urban campuses with so much food and amenities that they aren’t sending foot traffic out onto the street to support local, small businesses.

Taxable sales are still growing slowly, however. There was a 10 percent increase in the area, compared to a 25 percent increase in the rest of the city. I think this would reflect the concern that several of these companies like Twitter are essentially closed urban campuses with so much food and amenities that they aren’t sending foot traffic out onto the street to support local, small businesses.

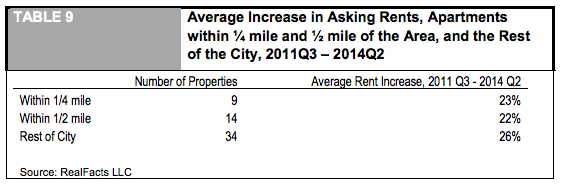

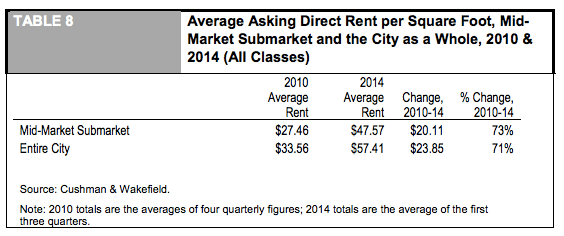

Increases in both commercial and residential rents were pretty much the same as the rest of the city. The gentrification and displacement risks in the Tenderloin are fundamentally different than they are in other neighborhoods like the Mission District. In the Mission and other outlying neighborhoods, many middle and lower-income residents are under rent control, and so they maybe at risk of eviction. However, in the Tenderloin, single room occupancy hotels are under an entirely different set of political protections.

So was it a success? If Twitter and other tech companies had decided to leave San Francisco, then yes. The city would have lost all the tax revenue and it probably still would have had the same housing and transit capacity issues because Twitter employees would have still lived in the city. (No, they wouldn’t have lived in Brisbane. That city is a municipal oddity in the Bay Area, with just 4,000 people and some of the highest city tax revenues per capita because it has all this industrial and office space and hardly any housing.)

However, if it merely incentivized Twitter and other tech companies to move into a specific part of San Francisco over other areas, then the results are more complicated. On the one hand, the tax break would have just subsidized a move inside the city. On the other hand, it might have led to more efficient use of commercial office space across the city without requiring more construction. San Francisco is certainly very constrained on that front.

Mid-Market Tax Exclusion – Three-Year Review