Update: Twitter is now down around 10 percent in after-hours trading. Its CEO, in an interview with CNBC, said that his company is the “fastest growing business” in the big-dollar digital advertising space.

Following the bell, Twitter reported its third-quarter financial performance, including revenue of $361 million and earnings per share, on a non-GAAP basis, of $0.01. The street had expected Twitter to report adjusted profit of $0.01 per share on revenue on $351.35 million.

Twitter, which broke from the market by falling nearly 3 percent in regular trading, is down sharply following its earnings beat.

The company’s revenue figure is up 114 percent from a year ago, and it had a GAAP net income of $175 million and non-GAAP profit of $7 million in the quarter. The company ended the period with $3.6 billion in cash.

On a GAAP basis, Twitter lost $0.29 per share.

In its most recent quarter, Twitter generated 85 percent of its revenue from mobile advertising. For comparison, in its sequentially preceding quarter, Twitter had revenue of $312 million and profit of two pennies per share.

Twitter’s advertising revenue rose 109 percent compared to the year-ago period, while its “data licensing and other revenue” category was up an even more impressive 171 percent.

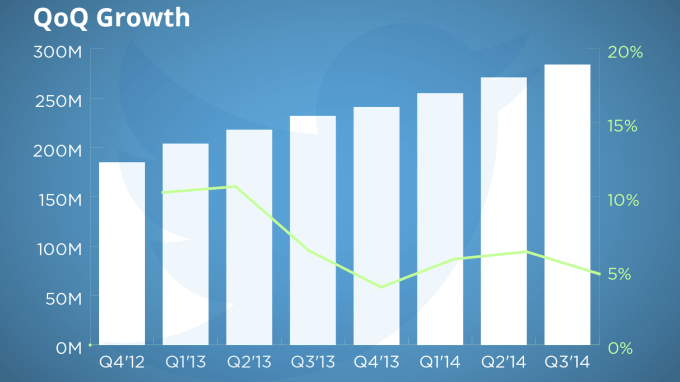

Twitter reported that it had 284 million average monthly active users during the quarter, up 23 year-over-year. That figure, up from 271 million, is likely being viewed by some investors as soft. Given that Twitter beat on revenue and met on profit, this is likely the chief catalyst for its current share-price declines.

The company picked up 13 million new monthly users in the quarter, down from the 16 million it gained in the preceding quarter. Slowing user growth is anathema to the company’s investors. That fact has dogged its earnings in now three of its four public reports since its IPO.

Twitter valuation, ending the day just north of $30 billion, is now substantially under that mark. For the current quarter, Twitter expects revenue of $440 million to $450 million, and adjusted EBITDA of around $100 million.

The company has a history of beating on its financial goals, and missing, or disappointing on user growth. Twitter has done an excellent job at monetizing its user base, in other words, but has had a harder time growing the base itself. If Twitter cannot expand its user base, no amount of short-term growth will make up for slower long-term potential revenue growth. Twitter needs to pick up more users to convince investors that has more hyper growth ahead.