Flint Mobile, a point-of-sale mobile payments solution originally built around snapping photos of your credit card instead of dongles or using other hardware to make payments, is today announcing that it has raised another $9.4 million in funding led by new, strategic investor Verizon via its Verizon Ventures arm; as well as an expansion of its service to the wider internet in a new service called Sell Online.

The Series C funding round includes follow-on investments from earlier investors Digicel, Storm Ventures and True Ventures, and also had participation from new investor Peninsula Ventures. It takes the total raised by Flint Mobile to just over $20 million.

Flint CEO Greg Goldfarb would not go into too much detail about the reasoning behind Verizon investing, but it sounds like this is more than just a pure financial interest.

“They see our strategy to focus on mobility for business as interesting,” he said in an interview. “I can’t talk about their strategic thinking and I can’t disclose things that are not yet announced.”

For its part, mobile carriers have long been trying to come up with initiatives to raise their profile with small and larger businesses to get them to take more enterprise services; and they also have taken many stabs at trying to figure out how to play a key role in the mobile payments industry — but with very mixed success.

Working with Flint, which has merchant and business customers in the “high tens of thousands” with average transactions in the range of $120, Verizon could have some hopes of tackling both of those.

When I first wrote about Flint in 2012 (at the time of a $3 million funding round), I noted that the absence of any kind of dongle, or needing to rely on merchants investing in any kind of new hardware at all, was part of what made Flint’s services stand apart from some of the other point of sale solutions out there.

And indeed, this case proven to be the case, Goldfarb says, with its customers coming in large part from the class of independent business people like fitness trainers and accountants who want to minimise the amount of equipment they use as they travel from client to client, but also want to have solutions help them take prompt, on-the-spot payments.

Yet just as payments alone have proven not to be a natural fit for a standalone business for the likes of Square and others, the same has applied to Flint.

The mobile payments service was doing fine, but Goldfarb said the company had started “to hear requests from customers who needed to bill in advance and send invoices,” which led them to integrate with services like Intuit’s QuickBooks to expand the product.

It has also included being one of the first companies to integrate Apple’s Passbook into a loyalty couponing service. (“We are looking at Apple Pay, yes,” Goldfarb says in answer to my question about Apple’s newest expansion of Passbook into commerce.)

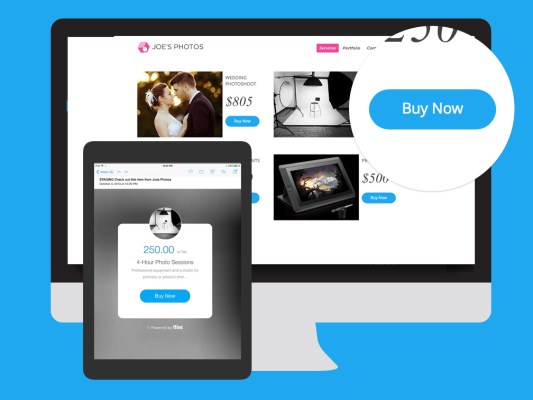

And this is where Sell Online, which lets Flint businesses add a payment option straight into their websites, fits in, stemming from requests from customers who want to offer basic payments from their sites that integrate with the rest of what they are doing with Flint.

“We’ve evolved from simple payments on the spot to giving people a way to run their businesses from the palms of their hands,” he says. “Later, we might start to look at booking services and appointments,” he adds. “It would be great to that through Flint as well.”

Sell Online is priced at the same rate as Flint’s mobile payments service — 1.95% for debit card payments and 2.95% for credit card transactions.