After nine months in a secret beta and a public launch in September, Indicative co-founders and serial entrepreneurs Jeremy Levy and Andrew Weinreich have managed to sew up $2 million in financing for their new company tackling the problem of how to provide low-cost analytics easy to use analytics software for web and mobile companies.

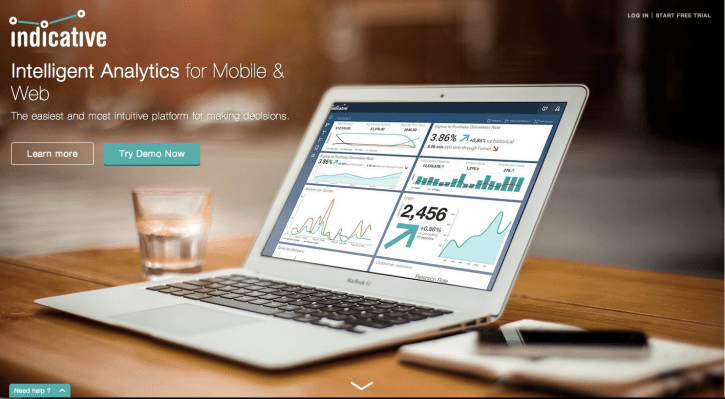

There have been over 50 companies launched that are targeting the broad “analytics market in 2014 alone, according to data from CrunchBase, but what Levy and Weinreich say sets their company apart is their ability to integrate data storage and analytics to give any user the ability to query and interpret data in an incredibly easy-to-use manner.

“We built a proprietary data store that allows us to store data very cheaply,” says Levy. “[And] we built proprietary visualization tools which are designed to be incredibly easy to use.”

For the two men, getting answers from data should be much simpler than having to learn SQL and run programming queries as an analyst. “All the time you hear people talk about business analytics and data analytics,” says Weinreich. “When all they really want to know is how much money I’m making and where my users are coming from.”

Weinreich says that’s exactly the kind of information that Indicative can reveal. Using the company’s software sales executives can get basic reports on where their customers are coming from — be it direct to consumer marketing or adwords through search engines. Moreover, the software can reveal which customers are more valuable — from the perspective of how much time they spend on the site and whether they’re repeat customers.

Cracking the code of who is coming from which location to browse and buy on a site is critically important to fledgling companies with little to no salesforce.

In fact, Weinreich and Levy launched this startup (their third venture together) to respond to needs they had as entrepreneurs at MeetMoi, the first location-based mobile dating service; and Xtify, which commercialized the persistent tracking technology at the core of MeetMoi. IBM bought Xtify in 2013.

The two men’s track record together, and the broad Indicative thesis was enough to attract an investor group including: Acadia Woods, Bertelsmann Digital Media Investments, David Rose, Jonah Goodhart, Brett Gough, Jamie Knall, Eduardo Vivas, David Reich, Matthew Grodin, Nils Johnson and John Rigos to invest in the company.

According to Weinreich, the use of the company’s analytics tools extends beyond the salesforce into the actual creation of new products for users. “A lot of folks build product based on what they think is best for their users,” he says. Using Indicative that data is visible in near-real-time to see what users are actually experiencing when they interact with a site.

“From the moment of [customer] acquisition to the moment of departure. Everyone of those touch-points should be organized in a database and there should be a series of tools that allows operators to base product decisions on actual data,” says Levy. “When someone is interacting with a service. that company categorizes each action that someone takes. When you store it you need to store it as registration, subscription. it’s not simply recording steps… It’s recording them according to a schema. The secret sauce is not in dropping something in hardware. The secret sauce is in putting together a schema that you can store at an incredibly cheap cost.”