CardBlanc, a new e-commerce application targeting millennial spenders officially launched today, introducing a financial platform for easier mobile checkout combined with social activity similar to what you’d see on sites like Pinterest or Wanelo. The effort, which involves an iOS app and virtual payment card backed by PayPal, aims to turn product discovery into real-world purchases by allowing users to not only see what their friends “like,” but also what they’re actually buying.

To use CardBlanc, consumers just download the app to their phones and set up an account. The “card” provided is merely a front-end to a PayPal account for now, but co-founder and CEO Tina Hay says they want to open up to more funding sources in the future, including credit and debit cards.

In the meantime, however, users can load funds onto their virtual cards by transferring from their bank accounts, or they can simply use their already established PayPal account, as they would anywhere else on the web, in order to check out quickly by pulling the necessary funds from a PayPal balance or a bank account already connected with that PayPal account.

While the financial platform under the hood is going to be a big focus for the company as it moves into the offline world with Point-of-Sale and Apple Pay integrations, peer-to-peer payments and more, today’s app is heavily focused on e-commerce and consumer spending behaviors.

“A lot of the sites – the PayPal’s and the Venmo’s – have some of the features [we offer]…but what we’ve built into the application are features that make it more social, more connected,” explains Hay. These features are designed to make shopping more attractive to younger adults and millennials, she says.

Purchases, by default, are publicly shared in CardBlanc, though users can opt to turn this off. That makes the app sound similar in some ways to an older startup called Blippy, which once tried to build a social service around publicly shared purchases, or, for a more modern-day example, Venmo’s social feed.

“We’re working with a generation that’s more open to sharing, and posting and being more open about purchases,” notes Ha, making the argument, as many post-Blippy services do, that Blippy was just too soon.

[gallery ids="1069553,1069552,1069551,1069550,1069549"]

At launch, CardBlanc works with over 100 retailers, including top stores like Forever 21, Saks Fifth Avenue, NastyGal, Urban Outfitters, Lululemon, Nike, TopShop, Neiman Marcus, J.Crew, Abercrombie, Victoria’s Secret and Bluefly. It’s effectively a mobile-sized shopping mall, where consumers can share what they like, get feedback in the form of comments and likes from friends, and then share their completed transactions. It’s the digital equivalent of a trip to the mall with friends, and not quite as creepy as a feed of everything you’re buying as its main, defining feature.

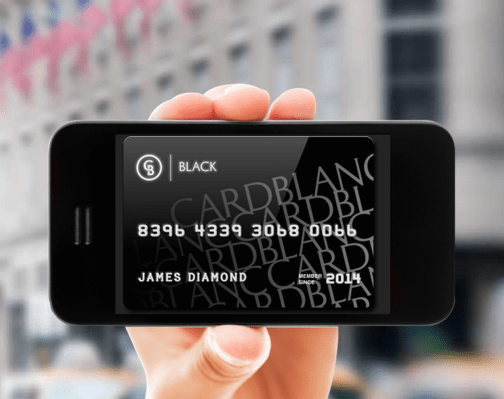

In the future, shoppers will be able to earn points for their purchases, too, redeemable for things like gift cards, electronics and more, leveling their way up from a white card to a red then gold then platinum, and, finally, a black card.

More consumers today, and especially the younger market CardBlanc is targeting, are shopping from their mobile phones. And it doesn’t make sense to download native applications for all the retailers you occasionally frequent.

Meanwhile, though companies like Pinterest, Wanelo, Polyvore and others have done a good job at growing sizable, engaged user bases, they sometimes still flounder when it comes to conversions. Products shared on the sites eventually disappear from inventory and drop offline, leading users to “liking” and re-sharing dead links. Consumers may click through and find nothing to buy.

CardBlanc’s focus on the current transactions and not just the “aspirational” saves and clicks could give it an edge, presuming the company can figure out how to gain traction in a crowded market and an over-stuffed App Store.

Santa Monica, Calif.-based CardBlanc, also co-founded by CTO John O’Connor, is a team of four, with a small angel round led by Tom Dolby. The startup is currently raising a larger seed round.