WePay — a startup from Palo Alto that competes against the likes of PayPal by providing payment services for marketplaces, crowdfunding platforms and other sites that enable online transactions between third-party buyers and sellers — is taking on another payments juggernaut, Stripe, with the launch of a new product. WePay Clear is a white-label, API-based service that works similar to Stripe that also offers a no-fraud guarantee.

The average online merchant loses up to 1% of all transactions to fraud. “Since WePay takes on fraud management & covers losses, our partners immediately save money,” CEO and co-founder Bill Clerico says. “These savings come from both what they would have lost to fraud, as well as reduced spending on systems to prevent fraud.” Clear uses WePay’s Venda risk engine, which monitors social interactions and other signals to verify a user’s identity.

WePay Clear, which works both on desktop web and mobile apps, is already live in the U.S. with launch partner for WePay Clear is Freshbooks. WePay is also now rolling out the product in Canada and testing it in Europe, Australia and other markets. “International expansion takes longer for us than for some other companies, since we’re not just enabling payments, but also managing fraud risk in these new geographies,” Clerico notes.

Clear is the white-label evolution of another API-based product the company first launched in 2011 called WePay Connect. Connect also comes with a no-fraud guarantee and has some 1,200 platforms-as-customers with some $1 billion in transactions processed to date, Clerico says.

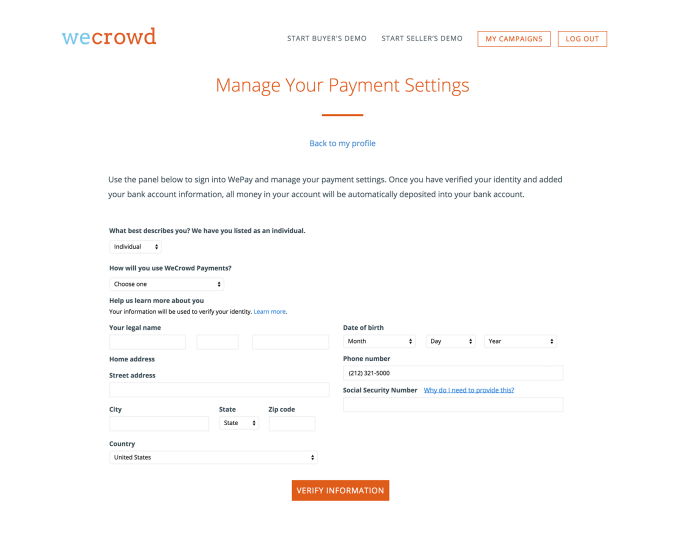

The reason for adding white-label functionality into Clear came out of two trends: the first is the growing amount of payment integration that we are seeing in apps (as opposed to redirecting to other sites) and the second was WePay’s customers (and potential customers) wanting to retain more of an own-brand experience, “without their customers having any relationship with or knowledge of WePay.”

“This is hugely valuable to companies that want to offer payment as a branded part of their service, but don’t want to manage fraud risk themselves,” Clerico says. This is the key point: while there are companies (like Stripe) already offering white-label payment services (but no fraud protection: see here) and those offering fraud protection but no payment engine, Clear claims to be the first to offer both together.

“There are ways with other competitors to build branded, platform-like functionality and there are ways with other competitors to offload the management of fraud risk, but not both,” Clerico notes. “WePay Clear is the only product on the market that offers a seamless, branded payment experience for platforms while also insulating them from fraud risk.”

[Update: In a Hacker News post, Clerico clarified a bit more about how the fraud protection and white-label aspects differ between Stripe and WePay, pointing out that Stripe does in fact have fraud protection, but delivered in a different way. “Yes, WePay Clear takes on fraud responsibility & shields the platform. (as does Stripe Connect),” he wrote. “However, WePay Clear does this in a whitelabel fashion, so that sellers on platforms do not need to create a WePay account. In other words, it’s not just fraud protection or whitelabel – it’s whitelabel payments AND fraud protection.”]

WePay Clear is charged at a flat rate that mirrors Stripe’s — 2.9% + $0.30 per transaction, although the company will modify those rates on a case-by-case basis depending on the partner.

Clerico says that today “the majority” of its $1 billion in payment volume is through partners in the crowdfunding space. The idea has been that by mastering the payment dynamics of crowdfunding, WePay will can use that knowledge to build out its business into other verticals.”Our strategy was to start in this vertical, and then expand into marketplaces and other types of small business software – something that WePay Clear and our partnership with Freshbooks helps accelerate,” Clerico notes.

WePay, which was founded in 2008 and originally incubated at Y-Combinator, has raised just under $35 million in funding, with backers including Raymond Tonsing, Maynard Webb, Max Levchin, Philip Purcell, Ignition Partners, Highland Capital Partners, August Capital and SV Angel.

Main image: Flickr