When you have one of the most experienced CEOs in the industry, who led Macromedia and oversaw the development of Adobe Flash in the 2000s and then changed online video again by taking Brightcove public, people pay attention.

So when Jeremy Allaire said he was entering the Bitcoin space, top-tier venture firms took notice. Jim Breyer, who was one of Facebook’s very first investors, Accel Partners and General Catalyst quickly lined up to put $9 million in a year ago even though the company had yet to launch a product. They soon tacked on another $17 million, as everyone else in the space bulked up on funding given the regulatory and legal costs.

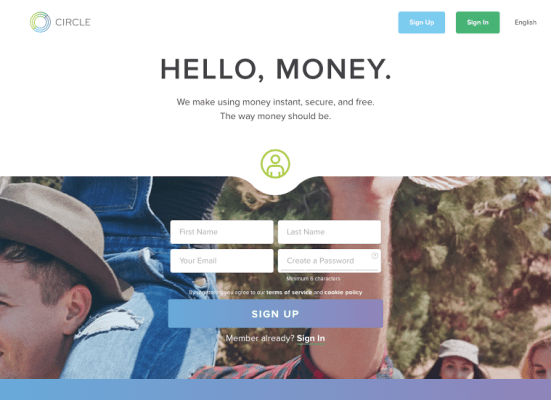

Now it’s finally emerged from an invite-only phase and is fully open to the public. Don’t call it a Bitcoin wallet though.

Allaire and his company wanted to build something that was deeply accessible to everyone, not just crypto-currency enthusiasts.

Even though Allaire and his team don’t like to use the word “wallet,” Circle pretty much is one.

You can quickly sign up for Circle with an e-mail address, phone number and some credit card or bank data, so you can store or send Bitcoin. The whole process only takes a few minutes, unlike some of the early Bitcoin storage services, especially ones that are based offline. There are password retrieval questions, unlike other wallet services where you might have to remember a mnemonic or risk losing your account permanently. (Of course, web-based solutions have faced some criticism that they’re less secure than desktop wallets. Circle is built with a multi-signature architecture.)

While Circle feels like its coming a bit late to the party because rivals like Blockchain and Coinbase have roughly 2 million wallets each, it does have a few interesting features.

“We created this frictionless ability to on-board and link a bank card for spending,” Allaire said. It’s really easy and fast to add credit cards to Circle. Coinbase, one of Circle’s biggest rivals with backing from Andreessen Horowitz and Union Square Ventures, has the ability to connect banking and checking accounts. But its credit card function has a one to two day lag because you have to verify a couple small test charges from the platform.

Allaire also insists that there’s still plenty of room for the Bitcoin market to grow.

“The actual number of mainstream consumers using Bitcoin for payments versus buying to hold it is in the low hundreds of thousands,” he said. “This is by far the most vibrant and passionate ecosystem that I’ve seen since the mid-1990s, and there’s so much activity.”

Circle is also stressing its international profile. It’s available in seven languages. But this is more of an interface element, as the ability to link a bank account exists only in the U.S. Coinbase, in contrast, recently expanded to more than a dozen European countries.

They’ve also built an insurance program that will cover 100 percent of a user’s full deposit value through a relationship with Marsh. Another Bitcoin wallet that targets high-net worth crypto-currency investors called Xapo, that’s backed by Benchmark, offers insurance, but it’s for a higher-tier of storage called the vault. Coinbase also offers insurance that covers the average amount of Bitcoin it holds at any time and protects against security breaches or employee theft.

Circle is also bringing native and iOS apps soon, which will bring it line with other competitors.