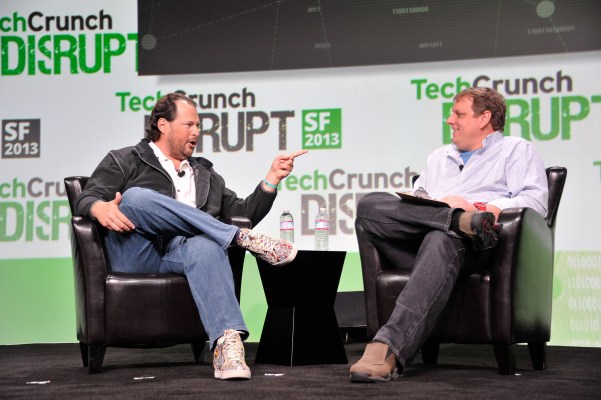

This morning at Disrupt SF, TechCrunch alum Michael Arrington interviewed Salesforce.com’s Marc Benioff about his investments, his company’s growth rate, and his personal approach to politics.

Salesforce recently announced a $100 million fund that it will invest across the technology industry. Arrington found the exercise minor enough to almost call it branding, noting that Salesforce has invested heavily in younger companies for years preceding the creation of the fund.

Benioff stated that his company has had a “great time” with its investments, adding that it’s invested more than $100 million into outside technology firms. Its approach isn’t specific to industry or size of funding round. He cited mobile, social and cloud as potential investment targets at the seed, A, B and C levels. That means Salesforce will pretty much invest however much it wants, in whomever it fancies with this new vehicle.

One key question Arrington asked was how long can Salesforce grow at nearly 40 percent, year-over-year? Benioff demured the question, merely saying that he “agrees that [his company’s] numbers are incredible. He also noted that the company had just raised its full-year guidance to better detail future growth. Salesforce will have revenue of more than $5 billion this year.

In its most recent quarter, Salesforce beat on both revenue and non-GAAP profit.

Arrington went on to press Benioff on his political donations and whether he had ambitions in politics. The CEO declined to identify with either political party: “I’m not a Democrat or Republican, I’m an American. I give everyone a lot of money.” His political investment strategy therefore appears to mirror his investing strategy: “If I like some person I will give them money.”

Despite this apparent batting-away of the question over his political ambitions, Benioff did, despite his pleas to the contrary, somewhat resemble a politician in his demands.

He listed his four political ‘wants’ that he brings up with politicians he meets: immigration reform, including more H1-B visas for high-skill applicants; patent reform, which recently died in the Senate (“Hilary killed it” he said); some sort of simple repatriation program that would allow large companies to bring home their foreign cash reserves (he suggested the government could take 15-20 percent of repatriate profits in return); and stronger fiscal policy at home to reduce the risk of future economic instability. A balanced budget, in other words.

Asked if he thought a repatriation tax might look like a tax break for the rich, he dismissed the criticism, saying “we have to get that cash back to create innovative companies.”

What did he think of Apple? “I told my Mom to invest in Apple.”

Benioff also did some future-gazing on stage, saying he envisaged a new future where wearables were highly integrated with the enterprise, enabling business people to tack the health of their company just as they might track their daily steps.

He also made a big play of Salesforce’s work to support the UCSF Benioff Children’s Hospital and education programs in SF, and he called on other technology companies to leave far more of a legacy than just their products by donating to good causes.

[gallery ids="1055994,1055993,1055992,1055991,1055990,1055989,1055988,1055987"]