MagForce injects iron oxide nanoparticles into a patient and then vibrates them with a magnetic field to generate heat that helps kill cancer cells. It sounds like science fiction but it’s real. That’s why Peter Thiel‘s late-stage investment firm Mithril Capital just led a $15 million investment into MagForce’s new American subsidiary that values it at $65 million. Founded in 1997, MagForce is already listed on the Frankfurt stock exchange with $144 million market cap. The cash infusion will pay for the nanomedicine company to fund its development for use against more types of cancer, and the approval process in the United States. If MagForce’s NanoTherm treatment gets the greenlight in America, CEO Ben Lipps tells the company will IPO stateside.

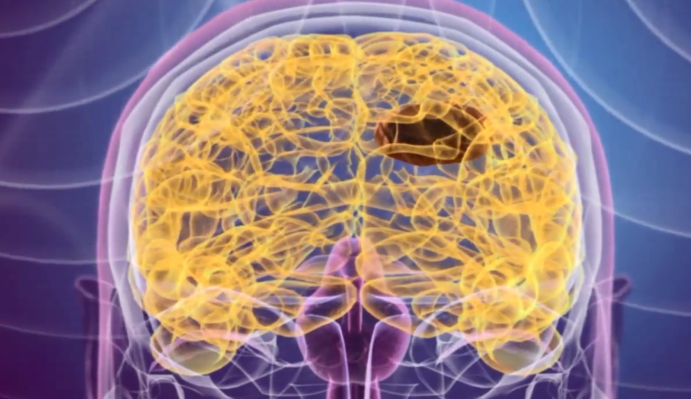

Here’s a look at how the NanoTherm process works:

Right now, the NanoTherm treatment is only available in Europe for fighting Glioblastoma brain tumors. A special coating devised by MagForce surrounds the iron oxide nanoparticles and prevents them from dispersing in the body when they’re injected into a tumor. The patient is then placed in a NanoActivator, which looks like an MRI machine. It emits a magnetic field and oscillates the polarity 100,000 times per second.

The nanoparticles act as transducers, converting the magnetic energy into heat inside the cancer cells, which makes them easier to kill. Lipps tells me radiation therapy is twice as effective when combined with NanoTherm, so it can either have double the cancer-killing power or the dosage can be halved to reduce side effects.

Mithril Capital Management and other strategic investors will get 23% of the American MagForce subsidiary for their $15 million investment, and will have the option to buy $15 million more of stock at this price within the next four years. The money could let MagForce develop NanoTherm for use on prostate cancer along with backing the company for the next two to three years that it could take to get approved in the US.

As for why MagForce wanted Mithril in on the deal, Lipps tells me “I was interested in having a US investor who is known to be quite thorough. It lends credibility”, alluding to Thiel’s propensity for due diligence.