The new partnership between IBM and Apple may be a wake up call for Google and companies building Android-based handsets and services targeting enterprise users. But for BlackBerry, it may be more of an alarm bell.

BlackBerry’s shares were down by more than 10% in trading this morning (they’ve been fluctuating) in the wake of the news that IBM and Apple would be creating “more than 100” enterprise solutions and native apps for iPhone and iPad devices, coupled with a cloud services offering spanning mobile device management, security and analytics; a new class of AppleCare support for enterprise users and more. In other words, a bundling of services and devices that will serve as a one-two punch against an opponent who was already wobbling in the ring.

BlackBerry’s CEO John Chen was quick yesterday to issue a statement in defense of BlackBerry’s position in the market.

The beleaguered device maker, which had been facing a declining earnings per share even before yesterday’s news, had recently put all its money, so to speak, off consumer and back into the enterprise business that helped put its name on the market many years ago. The news, he said, “only underscores the ongoing need for secure end-to-end enterprise mobility solutions like those BlackBerry has delivered for years,” according to a statement published in Canada’s Financial Post.

He also called BlackBerry the “clear leader” in the enterprise market.

But those words are sounding increasingly hollow. Even before yesterday’s news, BlackBerry was not in a great position.

Once the market leader for smartphones in North America, and one of biggest producers of smartphones worldwide, BlackBerry has already dropped down into the “others” category for global shipments, with not even a namecheck in Strategy Analytics‘ most recent quarterly smartphone reports, or Gartner’s most recent mobile forecast for 2014.

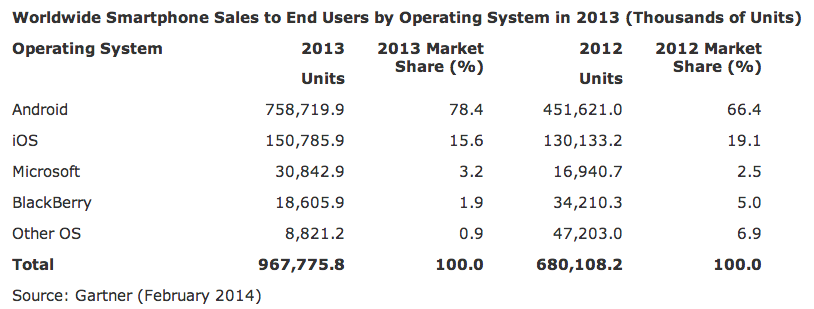

Blackberry’s share of smartphone sales in 2013 dropped to 1.9%, or 18 million units, from 5% (34m units) in 2012, Gartner says. Eighteen-million doesn’t sound too shabby, until you consider what the market leading platform is pulling in.

Here’s the full breakdown:

“Enterprises should think twice about relying on any solution built on the foundation of a consumer technology that lacks the proven security benefits that BlackBerry has always delivered,” Chen’s statement reads.

But if anything, the deal between IBM and Apple is a sign of anything but this happening. It’s a clear sign of the consumerization of IT — the idea that enterprises and more specifically the people who work in them are adopting and being influenced heavily by technology originally built as consumer services.

“iPhone and iPad are the best mobile devices in the world and have transformed the way people work with over 98 percent of the Fortune 500 and over 92 percent of the Global 500 using iOS devices in their business today,” Apple CEO Tim Cook said in a statement yesterday.

Partnering up with IBM, one of the biggest name in IT services, will extend that credibility, to the detriment of BlackBerry (and, incidentally, all of IBM’s competitors) even further. If BlackBerry is intent on staying a player in enterprise, it will have to think fast about where it will turn next before it risks being marginalised even more.

Image: Flickr