Moven, a startup that aims to make it easier for people to manage their spending by offering money management tools and real-time spending updates in app form, has closed an $8 million Series A funding round, led by SBT Venture Capital.

Anthemis Group, Route 66 Ventures, Standard Bank, New York Angels and other angel investors also participated in the round.

Moven was founded back in 2011, and had raised some $4.4 million in seed funding prior to this latest round, according to CrunchBase. Its earlier investors included Kevin Plank, Esther Dyson and David Rose.

Back in March the U.S. startup took its app out of beta, after a soft launch in mid-2013 followed by an early invite beta. At that time it had 5,000 registered users and more than 100,000 invite sign-ups.

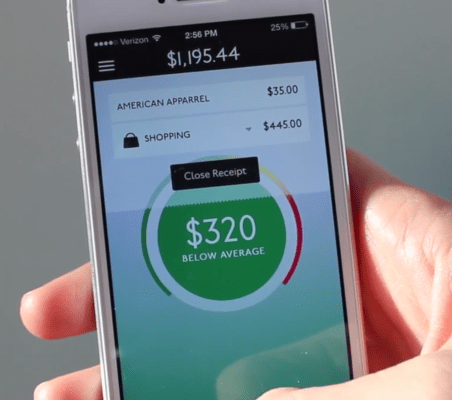

Features offered by the Moven app include real-time spending alerts and visualizations to help users budget better. While Moven is not itself a bank it does offer feeless Moven accounts which come with a debit card. These are backed by CBW Bank, an FDIC member based in Kansas.

As well as Moven accounts, the app also enables users to link external accounts so they can get a fuller view of their spending habits across multiple accounts.

Speaking to Wired today, Moven’s CEO said the company plans to use its new funding to fuel offshore expansion.

“The round will be used for expanding Moven offshore and we’ll be announcing two major global partnerships in the next few months,” said Brett King.

Canada and New Zealand are the two initial target markets for expansion.

King added that Moven plans to follow a licensing model as it expands internationally. Its partnerships strategy is aimed at driving app downloads substantially — it’s aiming for 10 million app downloads in the next few years, according to King.