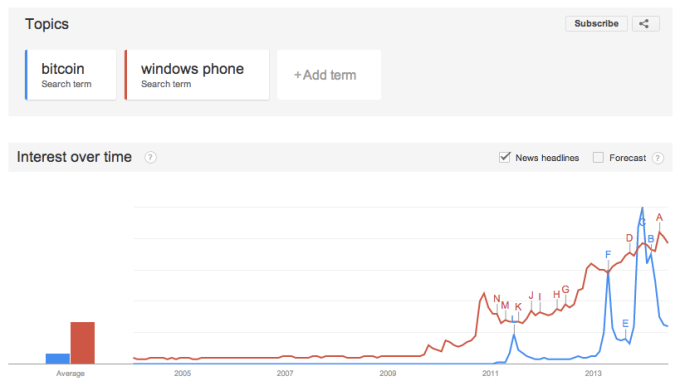

During the height of the 2013 Bitcoin bubble, Litecoin soared, crossing the $40 mark late in the year. Since then, mostly tracking Bitcoin, Litecoin’s value has faded. Today, you can buy a Litecoin for just under $9.

That cryptocurrencies are dealing with post-bubble excesses is hardly news. What’s more interesting is that Litecoin, which largely followed Bitcoin’s price fluctuations, has recently decoupled from its bigger sibling, failing to enjoy a price bump in recent weeks as Bitcoin itself found new legs.

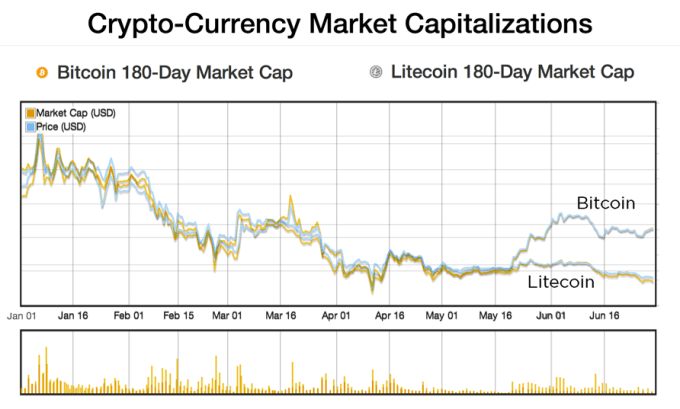

Using CoinMarketCap data, here’s the two cryptocurrencies’ price charts, superimposed over one another. Obviously, we discounted for scale, given that the price of Bitcoin has long outstripped that of Litecoin:

So, as Bitcoin recovered a bit from its 2014 declines, Litecoin didn’t follow suit.

A meme bouncing around the cryptocurrency world for some time said that Litecoin was silver to Bitcoin’s gold, given that more total Litecoin are in circulation now, and more will eventually be mined compared to Bitcoin’s hard 21 million coin cap. In fact, there are more Litecoin in the market now than there ever will be Bitcoin, but given that you can cut the cryptocurrencies into micro-pieces, it’s mostly a meaningless distinction.

Why would Litecoin decouple from Bitcoin? Bitcoin has been, I think that it is safe to say, the most popular way to buy Litecoin. But Bitcoin’s recent rally wasn’t driven by small-consumer demand, data suggests, but by larger Bitcoin-per-transaction purchases that pushed its market value up quickly. Those same purchasing patters didn’t impact Litecoin, it seems, throwing the linkage between the two away.

It remains an open question whether Bitcoin itself can become a large enough network that the average person will want to buy into the system, and transact their business using non-governmentally backed digital currencies. But if that’s a question for Bitcoin, it’s doubly so for Litecoin, which sports just over 10% of Bitcoin’s daily turnover (last 24 hours’ data).

Bitcoin remains an interesting, and growing experiment, but I think it’s also important to keep scale in mind. This is my current-favorite Bitcoin chart:

Big fat hat tip to Barry Silbert who first spotted the trend, and inspired this post.