Osper, a new UK startup, has come up with an innovative way to create a banking service than can be used by children, combining prepaid debit cards and smartphone apps controlled by both them and their parents. The approach could potentially reach a market underserved by most banks, but which may also be embraced by parents keen to educate their children early on about how to manage money.

The startup has also announced it’s closed a $10m (£6m) funding round, led by London’s Index Ventures (which has backed SoundCloud and Etsy among others). Previously Osper had raised a seed round of £800,000 in June last year as an alumni of the Techstars London accelerator. The cash will be used by founder Alick Varma to launch the service out of beta, roll out in the UK and eventually expand abroad. It’s also enrolled the backing of major UK TV celebrity, Davina Mccall.

Other investors include Horizons Ventures (Li Ka-Shing’s venture capital arm – investor in Spotify, Facebook and Skype); Peter Jackson (CEO of Travelex), and Darren Shapland (ex-Chairman of Sainsbury’s Bank); as well as the entrepreneurs behind businesses including Streetcar, Lastminute.com, Jawbone, SoundCloud, Skyscanner and Funding Circle.

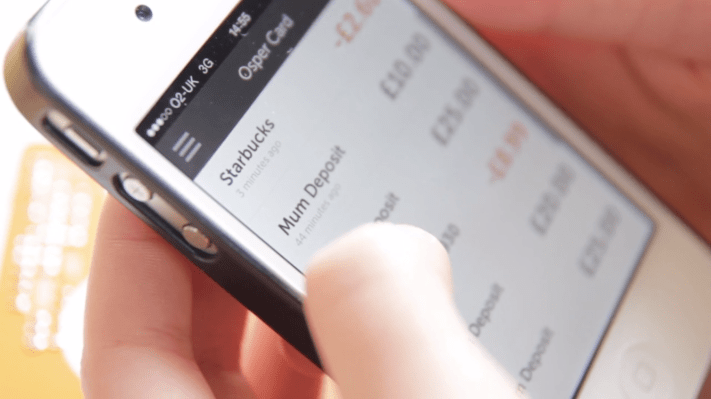

Aimed at the UK’s seven million 8-18 year olds (a 43 million-strong market in the US) Osper is a mobile-only, branchless, banking service. Its pre-paid debit card is ratified and backed by MasterCard and comes with a simple mobile app (Android or iOS), which has separate logins for the young person and their parents. The accounts have no credit or over-draft so the child or teenager can only spend what they have. The Osper Cards are free for the first year, and then cost £10 per year thereafter. The distinct orange card can be used in stores, for cash withdrawals at ATMs and for online purchases and service subscriptions such as Amazon and iTunes.

Because they can see how the money is spent, parents can hand over more of the decision-making to the child, who then – hopefully – gets smart about how to manage their money. It means parents no long need to hand over cash or lend their own credit card for online purchases.

The is key, because, as founder Alick Varma says, research has found that less than 30% of young people with a bank account use online banking and instead reply on cash or credit cards from parents. This is despite three quarters of young people in the UK having a bank account.

In other words, they need a new kind of service to encourage them to actually use a banking service. (Assuming they aren’t already on Bitcoin of course).

“There is a need to reinvent banking for young people; they should have the tools to build self-confidence to manage money from a young age,” says Varma, an entrepreneur who formerly trained as a maths teacher but went on to work at M-Pesa (the mobile-payments platform in Kenya), and Spotify.

The card and the app has several features that are likely to attract parents to the idea, such as the ability to monitor and manage Osper Card remotely, instant loading of cash, SMS alerts for transactions declined and card lock for stolen cards.

The company plans to make money via revenue from the ‘interchange’ when a transaction is made, the interest on deposits and the annual subscription fee.

It’s likely that Osper could do well in the UK, although it’s possible that a much larger incumbent bank could launch and market a competitive product. In the US the ‘Simple’ bank – which makes a virtue of its simplicity – might well be watching this startup with interest.