At the PreMoney 2014 conference in San Francisco this morning, Andreessen Horowitz managing partner Scott Kupor argued that there doesn’t seem to be a bubble in tech. In a presentation that lasted a bit over 10 minutes, Kupor laid out a series of trends that indicate things aren’t quite as exuberant as some fear.

Kupor argues that a lot of value creation today takes place in private markets rather than in public stocks. For instance, he brings up Microsoft’s market cap growth from the time it went public to today: a roughly 500x increase. Facebook, on the other hand, went public with a valuation around $100 billion — for it to have similar growth, its valuation would have to become larger than the value of the entire global public equity market today.

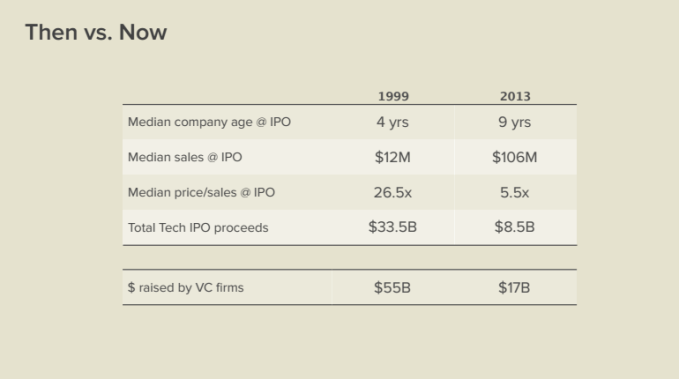

Why is so much value creation taking place before companies go public? For one thing, they’re taking longer to go public in the first place. Between 1999 and 2012, the average time for a tech startup to go public has more than doubled, from four to nine years.

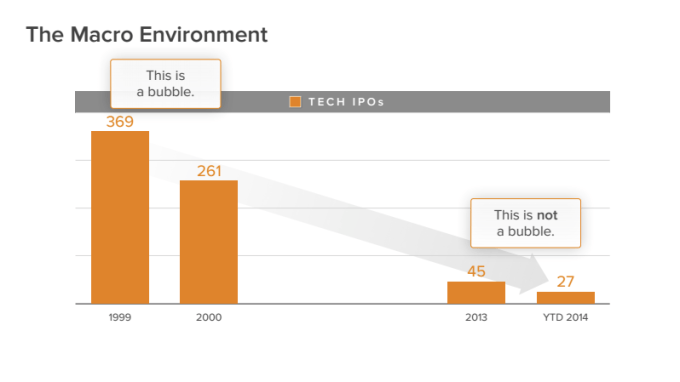

Because they’re going public later, these companies are often already farther along in the metrics that matter for valuations. In 1999, 80 percent of tech companies going public pulled in less than $50 million in revenue; last year, that number had fallen to 20 percent. Along with better fundamentals, there are also fewer companies going public. Fifteen years ago, 350 tech companies went public, while in 2013 only 50 had:

Tech companies are bringing in more revenue and have more reasonable valuations when they go public than they did in 1999.

Following Kupor’s presentation, Upfront Ventures partner Mark Suster explained why there are more opportunities for tech companies to scale, which would allow for the high valuations we’ve been seeing lately — once they found a winning formula. As you can see in the slide below, the market that companies can address has gotten much bigger, has more capable devices, and is more willing to spend money than in the last bubble:

In a group session following their individual presentations, both Kupor and Suster agreed that we may simply still be in a pre-bubble phase. Kupor noted three factors to watch: that late-stage valuations are being driven up by the arrival of corporate investors like Google Ventures and Alibaba; hedge funds raising capital to invest in late-stage funds; and the fact that it’s been five years since the last bear market.

As time goes on, the odds only increase that confidence will drop, which Kupor attributed to “the nature of these investment classes.”