The WSJ has published an article about how Google is planning to invest between $1 billion and $3 billion on low earth orbiting satellites, building on news also reported in The Information and SpaceNews around new hires and Google’s strategy to build out its broadband access business. We’ve reached out to Google to find out more and while the company would not confirm the stories directly, it did make sure we knew its wider position on the importance of Internet access:

“Internet connectivity significantly improves people’s lives. Yet two thirds of the world have no access at all,” said a Google spokesperson. “It’s why we’re so focused on new technologies—from Project Loon to Titan Aerospace—that have the potential to bring hundreds of millions more people online in the coming years.”

Even at this early stage, there are a number of reasons why the move is interesting, but also poses a number of challenges:

Tech Titan redux

Google is not the first major software-based Internet company that has eyed up ways of offering broadband access via satellite.

Back in 1999 and 2000, Microsoft made investments in two satellite companies, low earth orbiting satellite specialist Teledesic ($30 million for an 8.5% stake; not including independent investments made at the time by Bill Gates and Paul Allen) and Gilat ($50 million for a 26% stake), both with the intention to develop satellite-based ISP services. It was part of what appeared to be a bigger interest in satellite technology at the time, which also included taking a potential $1 billion stake in News Corp’s Sky Global satellite business (and, in 1997, a $1 billion investment in Comcast to “enhance high-speed data and video services,” but not specifically around satellite).

What ended up happening? Not much, it seems. Teledesic suspended work in 2002 on its venture; and while Gilat is still around, providing remote areas with Internet access, it’s also pushing more of an enterprise model, with services for verticals like the defense industry. It’s not apparent where Microsoft fits into that, if at all.

It’s pretty clear why companies like Google and Microsoft, whose business interests today are largely around software, would want to move along the value chain to cover access. At a time when net neutrality tides appear to be swinging in favor of large carriers, this potentially gives them ways of making direct connections to consumers, as a way to lead them more directly to your own services, or potentially as a complementary source of revenue.

Google is the first name in search, Google’s Android is the dominant mobile platform, and Google Chrome is becoming the equivalent in browser technology — it seems a no-brainer for Google that it will want to complete the circle by providing the access layer as well.

For a company like Google, this could extend well beyond a consumer play, too: the company has been making deeper inroads into services for the enterprise market; and, with acquisitions like Nest, into that slightly nebulous area that we call “the Internet of things.”

Why could this turn out differently for Google than it did for Microsoft? I’d argue that Microsoft was probably doing exactly the right thing, but at the wrong time.

Back in 2000, before the smartphone revolution, the market was significantly smaller, and carriers still had way too much power; and the economics of satellites have moved on a lot, and continue to do so in the next five years — with satellite companies, some believe, ripe for the picking.

Carriers are swimming in the other direction

Microsoft’s early attempts to move into the satellite business came at a time when carriers had a stronger hand in general in the game: with smartphones (and subsequent apps) almost nonexistent, and it was hard to conceive of a world in which carriers didn’t have a strong part to play in how information was delivered to us, either through fixed-line or wireless networks — and those wireless networks were a lot slower than they are today; 3G was more of a concept than a reality.

Ironically, these days carriers have shifted away from their basic fixed-line and voice businesses and into tapping future services for growth. Things like adding subscribers to their super-fast fixed and wireless broadband networks; video delivery are at the heart of how companies like Verizon hope to grow in the future.

But the shifting goalposts, however, also speak of erosion and of the market suddenly opening up to carrier alternatives. Text messaging and voice? We use iMessage, WhatsApp and Skype (or name your own personal apps). Up to now, broadband access has remained something of a sacred cow within that so it just seems crazy for that not to be next in line for disruption.

This is where satellite companies are fitting in: after a period in which we saw a number of failures of ambitious satellite projects (Teledesic being but one), we are seeing something of a resurgence of attention in this space, with the creation of much smaller birds and improving technology for using them to collect and transmit data.

We wrote the other day about Google’s interest in SkyBox for better mapping data, and when you think about this and the latest developments on Google eyeing up ways of developing broadband access via satellites, it speaks to the breadth of possibilities of where Google could go here.

Yes, there are still a lot of technical and financial hurdles around getting these devices up in the air and operating, let alone getting customers for the services once they are operational. But you can see how a company with huge cash reserves like Google, and with so much at stake if it cannot control access — hello, China — would be crazy not explore how to leverage all that.

Google’s broadband context

Needless to say, the idea of Google eyeing up broadband access via satellite is not coming in a bubble. Google has been making some significant moves to build out fiber networks for high-speed Internet access; and it has been apparently eyeing up other investments into satellite technology. Some of this is simply to provide better connectivity than what is already available; some of the moves are to provide access where there is currently none at all.

Google’s fiber business — lauded by no less than the chairman of the Federal Communications Commission — has been a very interesting development in the markets where it has gone live, such as Kansas City. But at the same time a number of analysts have pointed out the challenges that Google would face were it to try to achieve that with any kind of scale — scale being the only way that Google likes to do things.

One report from investment bank Bernstein, for example, estimated that it could cost up to $11 billion for a rollout that might potentially cover only 20 million people. And that’s before you consider that in early markets where Google wants to extend its fiber service, it could face a lot of local hurdles in getting things done.

Google is therefore taking to the airwaves to get around some of these kinds of issues. In addition to whatever it may end up doing with satellites, there are the assets of Titan Aerospace as well as how it might leverage Wifi for last-mile access, either on its own backbone or on that of a partner.

Beware Facebook, Apple and more?

Last but not least, there is the competitive threat for Google. Today, the company is the king of mobile and increasingly fixed internet with assets like Android, Chrome and Google.com.

But consider how Facebook has quickly grown to become the go-to place for many people online to communicate with each other, and with the outside world; and how Facebook has started to encroach into Google’s prime business territory: online advertising.

With the social network also pouring some significant time and effort into how to provide Internet access, Google’s interest in this space could also be a matter of trying to stay one step ahead of wherever Facebook, or whoever becomes its big rival, may choose to go next.

Speaking of competition, isn’t it interesting that this news about Google and broadband access has come out on the eve of a big event for another major player?

In any case, one sign that this is a long-odds game for Google can be found in the recent story on SpaceNews, which notes that L5/WorldVu, a company backed by Google that is developing a network of 360 low earth orbiting satellites, is not planning to be operational until 2019.

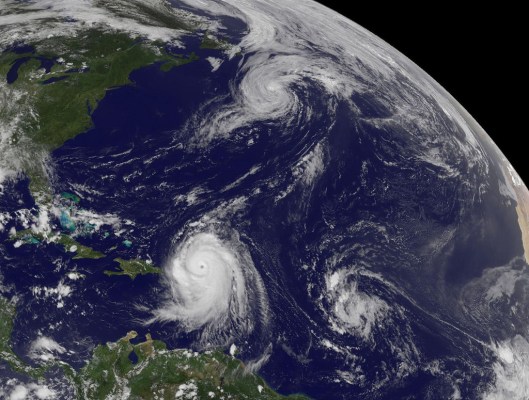

Image: Flickr