It’s been a rollicking few weeks in the stock market for Twitter, a company that has seen its share price knee-capped as part of a larger retreat of so-called “momentum” technology firms. That said, today Twitter is trending higher on the back of a report that forecasts growth for the firm in Asia, indicating that Twitter’s user base incline may not be the short-term problem that many fear.

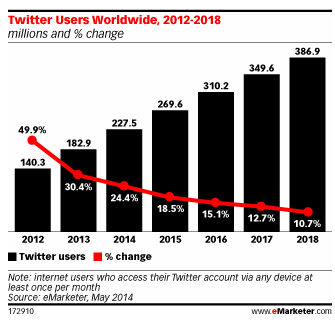

The report, however, does detail slowing expected growth in the coming few years. In short, eMarketer, the report’s progenitor, doesn’t expect Twitter’s growth to increase on a percentage basis.

That implies Twitter won’t catch Facebook’s usage numbers any time soon, let alone WhatsApp, and that it could be passed by Instagram.

As GigaOM’s Lauren Hockenson points out, the report has other negative points to it:

However, not all of eMarketer’s statistics were positive: The report found that Twitter may be over-reporting its monthly active user numbers. Researchers determined that Twitter had about 183 million active monthly users at the end of 2013, because they “rely heavily on consumer survey data to weed out business accounts, multiple accounts for individual users and other sources of potential double-counting.” That figure is much lower than the 255 million Twitter reported on its Q1 earnings report, and shows how nebulous Twitter’s numbers can be.

Here’s the reports nut graph:

That red line is Twitter’s pulse. As long as it points downward, market pessimism regarding the company’s future cash flows may linger. During the last three years, Twitter has demonstrated the ability to quickly grow its revenue on its user base. If that user base’s growth slows in the next several years, revenue growth could slip. And Twitter, which doesn’t generate GAAP profits, is valued on its top-line growth. As a company’s worth is essentially a metric based on its discounted future cash flows, Twitter’s overall luster could dim if its user numbers decline.