Another big round for a fast-growing enterprise startup focused on big data and the cloud. InsideSales.com has raised $100 million at a valuation of almost $1 billion, a number first reported by DJ’s Venture Wire, and now confirmed by us with a reliable source close to the company. Polaris Partners led the Series C round, with Kleiner Perkins Caufield & Byers the other major investor, along with participation from Salesforce, Acadia Woods, EPIC Ventures, Hummer Winblad, U.S. Venture Partners and Zetta Venture Partners.

A news release notes that the money is going towards expanding its products and moving into new markets, and the company tells us that part of that could include acquisitions.

“Acquisition is definitely a consideration,” CMO Mick Hollison in an interview. “This funding round definitely opens up that possibility for us.” As for what areas may be considered: “I think anything we may do will be in the market of sales acceleration. We’re definitely trying to build out more of a platform play ourselves. Right now we cover the four big areas of sales communications, gamification, predictive analytics and visualisation. But it is expanding over time and there are areas where we are not playing in that might like to be.”

InsideSales is one of the army of companies that is applying cloud services, big data and analytics to transform an area of enterprise services — in its case, sales. It sits between marketing automation services (think Eloqa or Marketo here) and giant CRM vendors like Salesforce or Microsoft, and its ambition, effectively, is to be the glue that connects them to help sales teams work better.

“Customers, partners and investors frequently ask us what our secret sauce is,” InsideSales.com CEO and founder Dave Elkington said in a statement. “Our secret sauce is our scientific approach to sales. We use data as a strategic weapon to systematically improve sales performance and drive sales growth for our own company and for customers who want to maximize revenue growth.” Its competitors include Velocify (formerly known as Leads360) and Five9.

The move comes on the heels of an SEC filing from last week that detailed the company raising a $100 million round but ultimately only reporting $79 million of it.

Its last funding round before this was a Series B of $35 million in January 2013, led by Hummer Winblad. But the startup — founded and still headquartered in Provo, Utah — went for years of being self-funded initially by its two co-founders, David Elkington and Ken Krogue, before taking its first round, a small Series A, in 2012 from Hummer Winblad and Josh James. “I guess you could say we were very stealth,” Hollison says.

Provo, indeed, is something of an uncelebrated tech satellite. Hollison describes business intelligence company Domo, which just raised $125 million, as “our friends down the road.” And Qualtrics, the online data collection company, is also nearby.

“Think of it as a more economical alternative to Silicon Valley,” he says. Ultimately we may get offices in San Francisco or elsewhere in the world, but this will remain our headquarters.”

Last year, when we reported on its $35 million Series B, we noted that InsideSales was among the group of enterprise startups inching towards an IPO. Hollison says that the size of this latest round is not an indication that InsideSales will not continue to move in that direction longer term.

“For us, we haven’t determined what that ultimate financing exercise will be, but this helps inject rocket fuel from a growth perspective in sales and product development,” he says. “We want to be a world class company and not get picked off by one of the bigger guys. That could come in many forms, one of which is an IPO.” In total, InsideSales has now raised $143 million.

The products

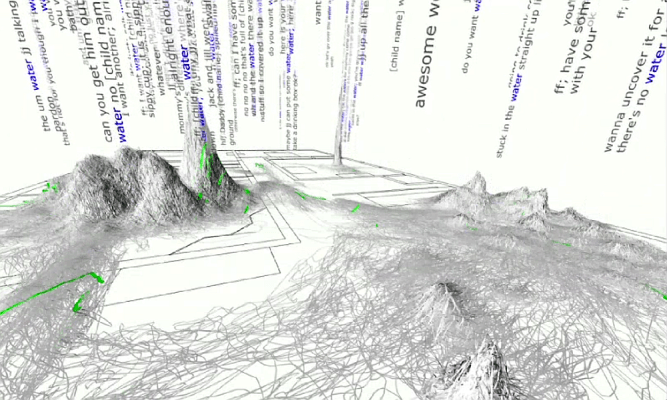

InsideSales’ mainstay today are two SaaS products called PowerDialer and mCall, respectively desktop and mobile apps that integrate with Salesforce and offer users sales communications, gamification, predictive analytics and data visualization.

The company says that in the last year it has seen growh of 107% with some 1,000 customers using its products, including large enterprises like Fidelity, Microsoft, Groupon, McGraw-Hill and Marketo.

InsideSales doesn’t spell it out but given the size of the round, I would not be surprised if we started to see some acquisitions coming from the company to bring in more features. There are a number of smaller startups out there right now making notable innovations, but the big question continues to remain whether you are a platform or a service that sits on top of a platform. This seems to be InsideSales’ way of indicating that they’re in to position themselves as the former, as they tap into what is estimated to be a market worth $12.8 billion for sales acceleration technology.

“Once in a while, a company has an opportunity to truly transform an entire industry,” said Dave Barrett, managing partner at Polaris Partners, in a statement. “InsideSales.com is that kind of company. The reinvention of the sales industry is a once-in-a-generation opportunity. The company’s patented technologies and runaway revenue growth, fueled by new customer acquisition as well as strong expansion of existing accounts, make it an incredibly attractive platform for the next generation of organizations who want and need to accelerate sales.”

Updated with valuation figure, comments from InsideSales.