This guest post is written by Ciarán O’Leary and Jade Read, VCs at Earlybird in Berlin. They invest across Europe in companies such as Wunderlist, Onefootball, SocialBakers, Auctionata, Rapidminer and EyeEm. Ciarán usually blogs over at Berlinvc.com.

What’s missing in the Berlin tech ecosystem? Well, a few things. But the elephant in the room really is one – no, a few – sizeable exits. This isn’t to create rich VCs, this is to create rich engineers – equipped with a wealth of experience and ideas – ready to have their next (or first) shot at building companies. And for this you need large liquidity events where the wealth is distributed widely throughout the entire company that has been acquired.

There is a lot of discussion about whether Berlin i) should have already had a few big exits (there have been a few in the several hundred million range; but we are talking $500m+, ideally $1bn+) ii) should have some big exits soon (next 1-2 years) or iii) should avoid (premature) exits and focus on growth, as its companies are comparatively young. .

To date there has been no shortage of opinions (including our own), but a shortage of facts – so we decided to crunch some numbers. What you really need to look at is: i) how old companies are and ii) how much money they have raised. It takes a lot of time and money to build a large company. Only with sufficient age and capital raised is it reasonable to expect a large exit. So, how does Berlin compare to other key European tech ecosystems and recent large European exits with regard to these two key metrics?

Age profile of key European tech ecosystems

Berlin’s top* startups are on average around 4 years old, with the oldest ones coming in at just over 6 years. This “age” pretty much coincides with the transition of Berlin from a local to a global tech hub – i.e. going from building local businesses to more disruptive global companies – which has been happening over the last 5 years or so. So it’s no surprise that most top startups fall within this age bracket.

* We are defined “top” startups as having raised at least one double digit round from a reputable group of investors. Debatable, we know ;)

London’s tech ecosystem is much older. This is reflected not only in the significantly higher age profile (average = 7 years, therefore 3 years older than in Berlin), but also simply in the number of top startups in the city.

Stockholm’s cohort is a little smaller so the conclusions have to be taken with a pinch of salt. The ecosystem has an older age profile than Berlin (average = 6 years), but a smaller difference compared to London. However both Klarna and Spotify are going on to their ninth year, putting them 2-3 years ahead of the oldest members of Berlin’s top cohort.

For good measure we also collected a bunch of startups outside of the main tech hubs and looked at their age profile (average = 7 years.)

To sum up the age profiling of ecosystems we looked at another simple metric: the % of “top” startups in each ecosystem that are older than 5 years:

Looking at all of the above, it seems fair to assume that Berlin’s ecosystem is, by quite a significant margin, the youngest of all major European tech hubs.

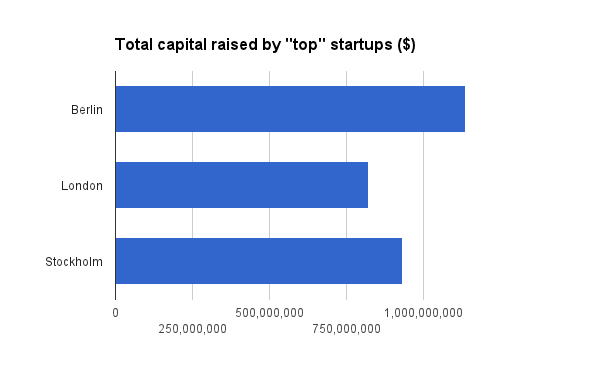

Capital profile of key european tech ecosystems

The other part of the equation is money. Here the situation is a little different – there seems to plenty of evidence that all 3 major tech hubs can attract significant amounts of venture capital not far off from each other.

Berlin’s top cohort has raised over a billion in venture capital in recent years, on par or even above other key European tech hubs. This fits with the DowJones report that Berlin had, for the first time, attracted more VC than London. Zalando certainly is an outlier here and the picture would look different without it – Stockholm has a very similar situation with Spotify; whereas London venture capital is more evenly distributed.

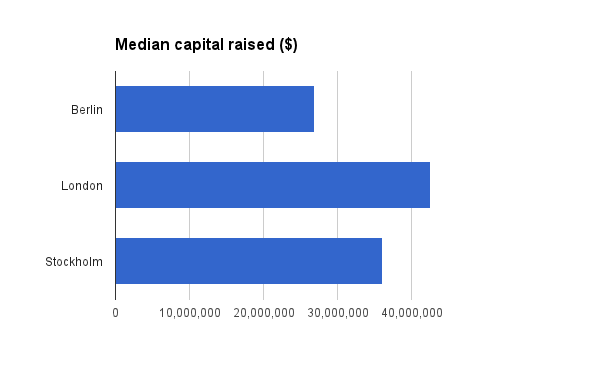

However if you look at the median amount raised the picture is (unsurprisingly) similar to the age profile of the tech startups. London’s top cohort has raised a median amount of $43m, Stockholm of $36m and Berlin of $27m. This makes sense as – all else being equal – an older ecosystem will have more advanced companies that have raised more.

Berlin’s average is pushed up significantly by Zalando* and Delivery Hero:

* The reported figures for total venture capital raised Zalando are certainly wrong. The company is likely to have raised many, many hundreds of millions (not unusual for a business with several billion in run-rate revenues). We went for 500, it could be slightly less or even more.

London seems to have fewer outliers**:

** We could not find data that made sense for Mind Candy and Zoopla. Hopefully someone will pick this up and do a more thorough exercise.

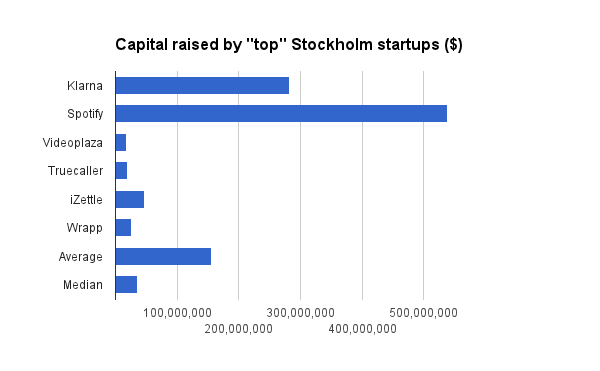

Berlin’s Zalando effect is echoed in Stockholm by Spotify and Klarna, rasing the average significantly:

It’s probably fair to assume that Berlin as an entire ecosystem has raised enough to produce a few large exits; however most of the top cohort will need 1-2 more large rounds (if you compare median raised) to make it to that point. This is what we should be looking out for.

Our last analysis on this matter, the % of startups that have raised more than $30m (our proxy for a minimum amount of capital raised for a large-ish exit – more details towards the end) lends further support to this.

Comparison to previous large European exits

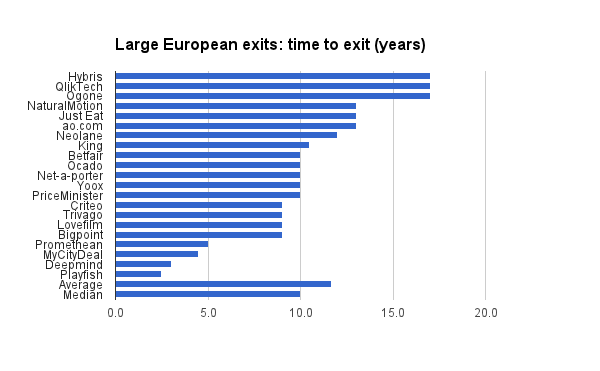

Of course comparing just privately held companies will not give you the full picture. What if all the top London and Stockholm companies just have already exited and hence we are comparing apples and oranges? So we took a look at “large” (starting couple of hundred million $) European exits* over the last 5 years and then compared these to the top cohorts of still privately held startups in each key hub.

* we excluded partial secondaries and assumed an exit is where all prior VCs sell their stake.

The median is 10 years, US benchmarks suggest 7-8 years. Quick exits are still an exception; it takes a lot of time to build very large companies.

Comparing time-to-exit vs age of current top startups shows that Berlin is still significantly below the 10 year average exit mark. The same can be said for London and Stockholm, although some of the top cohort there are much closer to this value.

We then looked at the total capital raised prior to exit, with the average sitting at the $60m mark and median at around $40m. (Note: the data here is very patchy so we could only use a few examples – a more thorough analysis is welcomed.)

Comparing the median capital raised prior to exit with the median capital raised by current top startups produces less of a clear argument, as the figures are not far off one another. Berlin is still the most divergent (median of $27m vs $40m), but the difference is not as plain to see as with age. London even has a slightly higher median amount raised already – $43m vs $40m.

We actually think this is good news: Europe is systematically creating much larger companies then ever in the past; so it is not surprising these are / will be raising more venture capital than past precedents.

So, there we have it. Some obvious conclusions but we really just wanted to kick of a more fact-based debate.

And if you view Europe as an ecosystem of connected dots (and you really should) – the quantity and quality of startups across all key hubs (and outside) combined makes a flurry of outsized exits highly likely. Maybe this is the real story here.

Disclaimer: we know the data is patchy. Our analysis probably wouldn’t stand up to the rigour of a peer reviewed academic journal, but we hope it is “directionally” correct. In fact we’d really like for someone with more time and attention to detail to pick this up and maybe do a much better study – we’d be happy to help. Please let us know where we screwed up in the comments section below this post (our sources are Crunchbase, Quora, googling, mixed in with some guesstimates.)