Yahoo’s acquisition train looks like it may finally have slowed down, at least in terms of value if not numbers. Yahoo noted in its Q1 2014 earnings today that it used a net $22 million for acquisitions in the three months that ended March 31, covering eight companies.

The tide could turn, however, post an IPO of Alibaba, which is expected to help Yahoo balloon its cash holdings to $12 billion from a current $4.6 billion.

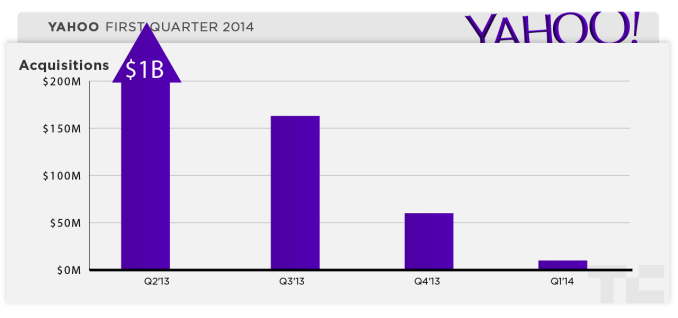

Sequentially, the $22 million net spent in the last quarter is just over a third of the net amount Yahoo said it spent on acquisitions in the quarter before that, when it spent $60 million, also to acquire eight companies, and just 13% of the net value it spent in Q3 of 2013:

- In Q4 Yahoo spent a net $60 million.

- In Q3 it spent a net $163 million.

- In Q2 it spent $1 billion in cash for acquisitions (including a net $970 million to acquire Tumblr).

- In Q1 it was $10 million.

The eight companies Yahoo acquired in the past quarter are Vizify, Distill, Wander, Incredible Labs, Tomfoolery, Cloud Party, SPARQ and Aviate. The only three we’ve had prices for were Tomfoolery ($16 million), Aviate ($80 million) and Wander (“over” $10 million). The reason for the numerical discrepancy could be because Yahoo is not calculating earnouts or share portions of acquisitions (Tumblr if you recall was an almost all-cash deal).

All told, Yahoo has acquired 38 different startups since Marissa Mayer took the helm as CEO, and if there have been themes to the furious buying it’s been to replenish the talent ranks at the company; to add more product focus in key areas like mobile, with the notable outlier of Tumblr, gave Yahoo an instant boost to its positions in social and with younger users.

The tide may change again after the Alibaba IPO. The company’s cash, cash equivalents, and investments in marketable securities was $4.6 billion at the end of the quarter, down by $400 million from the quarter before. The Alibaba IPO, however, is expected to balloon that to $12 billion.

Asked on the earnings call how Yahoo might spend the proceeds and whether there might be more acquisitions ahead, Marissa noted that there might be “some tuck in acquisitions, some strategic acquisitions,” without elaborating further.

“We will continue to think about how to maximise all the use of those proceeds,” Ken Goldman, Yahoo’s CFO, noted. “There are theories we continue to work on,” he added, which might be a reference to a large acquisition up ahead that would be as strategic as its move to pick up Tumblr.

“Finding an acquisition that would make sense…could help us scale… and think about international,” he noted later.

Among the many rumors of Yahoo acquisitions, the company has apparently been looking at News Distribution Network, the online video company, and Imgur, the popular photo sharing site.

Image: Flickr