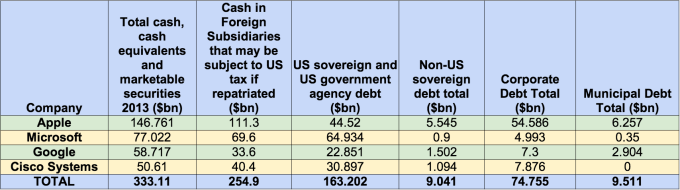

Tech giants, including Google to Apple, are notorious fans of offshore tax havens, which saves them billions of dollars. A new report from the Bureau of Investigative Journalism finds that “if this cash was brought onshore and taxed at the current US corporation tax rate of 35%, it would produce a $89bn windfall for the US Treasury – equivalent to 17% of America’s projected $514bn budget deficit this year.”

While the controversy isn’t new, these findings put a very high cost on not changing the tax code. “If a US multinational puts its offshore cash into a US bank and uses the money to buy US treasuries, stocks and bonds, those funds ought to be treated as having been repatriated and subject to US tax,” said Senator Carl Levin in response to the bureau’s report.

Here’s the breakdown of what many of the biggest names in tech stash abroad, much of which is held in U.S. agency debt.

Tech companies gave a standard reply to the report: “Cisco pays all taxes that are due”. Likewise, Apple said, “we pay all the taxes we owe – every single dollar. We not only comply with the laws, but we comply with the spirit of the laws.”

Apple CEO Tim Cook has argued that the company would support bringing more of its offshore accounts back to the U.S., if the government simplified the tax code. Some members of Congress, including Republican presidential contender, Rand Paul, have defended the practices of offshore heavens:

Either way, it is unclear whether Congress will get around to revising this particular portion of the U.S. tax code this session. Congress still has to debate immigration reform and reforms to the NSA — all in an election year that will gear up in a few months.

Image: Flickr User JD Hancock under a CC by 2.0 license