There are more than 2.5 billion people without a credit score in the world today, which means that there’s no way for them to find banking help when they need it. A new startup called InVenture is looking to solve that problem, with personal finance tools that not only help the underbanked keep track of their finances, but also helps provide them with a credit score.

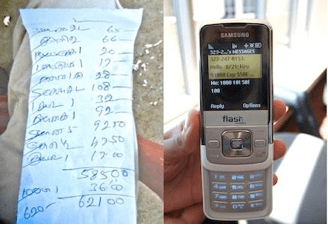

On the one hand, InVenture provides its users with tools, via SMS and an Android app, to keep track of their daily finances. The company’s InSight mobile phone software is designed to help users in developing countries to manage spending and expenses via SMS and interactive voice response on feature phones. On Android, the company provides its own mobile app.

But that’s only part of the story. The bigger picture is that by helping users manage their daily spending and increase their savings, it can also validate their financial worth.

That helps solve the huge problem, especially in developing countries, of consumers who have no record on file with various credit agencies or proof of creditworthiness. It has built-in credit scoring, based on the income, savings, and spending levels that its users report through its apps.

That gives financial institutions a fuller view of their current financial situation and purchasing power. Not only that, but according to founder and CEO Shivani Siroya, the data it collects is a better proxy for being able to pay back a loan than traditional credit scores because it’s a measure of their current cash-flow data instead of their previous repayment history.

Siroya decided to tackle the problem after working at the U.N. researching and building costing models on reproductive health and microfinance. She also has a background in banking and healthcare M&A. After self-funding the initial finance-tracking app for the underbanked in developing countries, she and her team later began licensing the resulting data to financial institutions to help them with credit scores and lending programs.

The company has been partnering with a number of financial institutions, mobile transaction providers, and app makers to get greater distribution. By doing so, it’s hoping to reach a broader number of underbanked users and get them using the service.

InVenture has raised a total of $2.1 million, including a $1.2 million seed round led by Chris Sacca’s Lowercase Capital. Other investors in that round include Google Ventures, Collaborative Fund, and Mesa+, who joined previous investors Mumbai Angels and Dogster founder Ted Rheingold.

As part of the new round, Sacca has taken an active role as part of the company’s board of directors. And Rheingold, who had previously been an adviser and mentor, joined the company as its COO earlier this year.