Just as the JOBS Act kick-starts bigger markets for shares of privately held companies, NASDAQ is launching its own entrant in the field.

The U.S. stock exchange, which hosts tech companies like Apple, Google and Facebook, is finally opening its private company marketplace to let growth-stage companies tap institutional investors for capital and employee liquidity.

They’re part of a growing number of players like SecondMarket, AngelList, Funders Club, WeFunder and Equidate that allow private companies to raise capital from a broader number of investors beyond traditional VC firms.

Greg Brogger, who started an early platform called SharesPost for buying shares of pre-IPO companies and is now managing the new program, says that NASDAQ’s new market is tailored to let companies have more control over the process.

They can use the platform to let early employees sell their shares while managing who can buy and sell shares, how many shares can be sold at any time, and the timing of transactions and the depth of financial disclosures to prospective investors.

“What we’re allowing companies to do is take control of secondary market for their shares,” Brogger said.

(In the early days, SharesPost would let buyers and sellers contact each other independently. It turned out that many privately-held companies like Twitter didn’t want this because they wanted to understand who was on their cap table and who had access to information on their performance.)

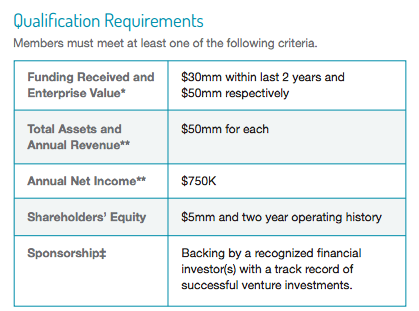

To join the program, these companies need to have at least $30 million in funding over the past two years or have at least $50 million in enterprise value; or they need to be profitable, with at least $750,000 in net income.

The ideal company probably is raising somewhere between $20 million to $50 million on the platform, Brogger added.

They have about 15 to 20 companies signed so far and have identified about 500 more that could be a good fit. Brogger said they can’t disclose the identities of participating companies at their request.

Getting in relationships early with growth-stage companies could help NASDAQ lure companies into their exchange once they go public over rivals like the NYSE, which scored IPOs like LinkedIn.

NASDAQ says its new private market will help companies start a dialogue with long-term institutional investors, who might end up holding their stock for years on public markets.

The exchange is encouraging companies to share two years of trailing financial data, but no forward-looking statements or predictions. They’re also encouraging, but not requiring, companies to hold annual meetings for their shareholders to ask questions.