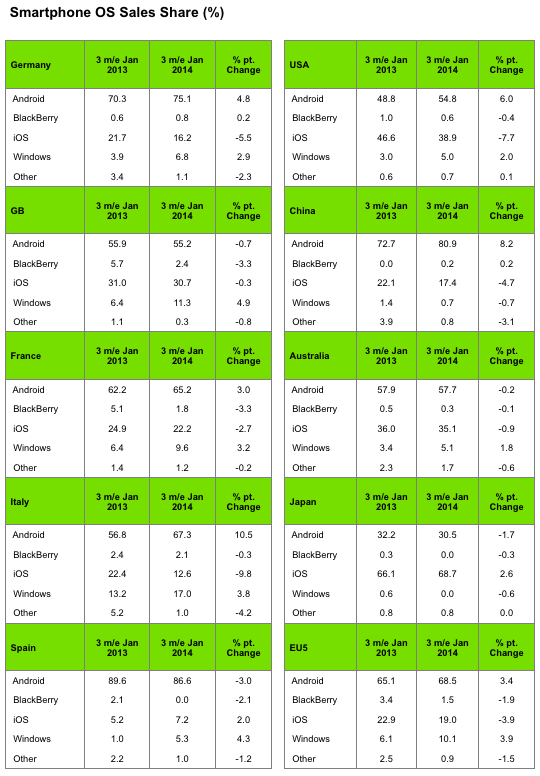

When it comes to sales of smartphones, Android is the green giant that continues to tower over the competition. In the last three months that ended in January 2014, the Google-developed operating system accounted for around 70% of sales across 12 key markets, according to the latest figures from WPP market research division Kantar Worldpanel ComTech.

In comparison, its most credible rivals either fell further behind, or simply stood still: Apple took 22.1% of sales (down nearly two percentage points over last month); and Windows Phone was flat at 4.4%. A mixed bag of “others,” which includes BlackBerry but also legacy, discontinued platforms such as Symbian, accounted for the rest.

With Google’s mobile platform installed on 7 out of every 10 smartphones that consumers buy, Android seems almost impossible to beat. But with reports of even arch competitors like Nokia toying with Android devices, the question may no longer be which platform is dominant, but what the state of play is with OEMs building on top of that outsized leader.

Samsung continues to sit on the top of that pile. Kantar director Dominic Sunnebo tells me that in the last three months Samsung took 32.6% of sales across 12 key markets — up slightly from last month’s 32.2%.

But when you drill down into regional sales, you start to see specific manufacturers giving the Korean giant a run for its money.

In the case of Europe’s big five markets of UK, Germany, France, Italy and Spain, for example, Kantar notes that “Samsung’s dominance of this market is being eroded” — much as it observed last month.

“In Europe Android continues to move towards 70% share, and the real battle now is among the Android manufacturers,” writes Sunnebo. Samsung has over half of all sales at 39.5%, “but this is lower compared with last year.” In contrast, LG (6.9%), Sony (9.4%), Motorola (1.7%) and even new brand Wiko (2%) all are seeing growing market shares of sales — a trend that Kantar contends will continue with the launch of new devices at MWC this week.

Meanwhile, some notable things about Apple. iOS-based devices saw sales declines in a few markets, but surprisingly, the biggest of all was in the U.S., a country where Apple has traditionally been strongest. In the last three months in the U.S., sales of Apple handsets were down 7.7 percentage points to 38.9% of sales compared to a year ago.

But interestingly, Apple is also seeing something of a shift in terms of what consumers are buying. Whereas sales of its new 5s devices have been dominating globally, now the less expensive 5c is seeing a mini surge.

In one example — the very saturated market of the UK, where smartphone penetration is 70% and 86% of all handsets sold in the past three months were smartphones — Kantar says the 5s model outsold the 5c 3:1.

But with 5c sales picking up to become the number-three smartphone in the UK, now the ratio is 2:1. So: still outselling, but less so. The U.S. is seeing the same ratio, Sunnebo tells me, while Japan and Australia are still seeing 5s outsell the 5c at 3:1 and in China there are nine 5s devices sold for every 5c.

The China proportion, when you think about it, is not that surprising: there, Android completely dominates the middle and lower end of the smartphone sales spectrum, so if you are going to put the cash out for a premium iPhone, you are likely to go for gold. Or: in for a penny, in for a pound, as the British like to say.

Why the bigger shift to 5c? My theory is that now that the rush of early adopting iPhone 5s users have somewhat abated, the later wave is slightly more price sensitive, and that’s leading some to opt for the (ever so slightly) more economical model.

Something else that Kantar points out with the iPhone is that demographics and usage vary depending on whether you are a 5s or 5c user: in the UK, 74% of 5c buyers are female, versus 36% for the 5s. It notes that 5s users are also more inclined to use their handsets for “data heavy” uses like video and music.

In other platforms, Windows Phone continues to struggle in certain markets like the U.S. — where Microsoft’s Joe Belfiore today admitted that the company continues to see a “tough market” with consumers, and Kantar notes it took just 5% of smartphone sales in the last three months.

But in others regions like Europe its performance is more positive. Windows Phone’s share of sales in the last period was just over 10%, and it is the fastest growing platform in Europe, putting it ever closer to Apple — which is currently at 19% of all smartphone sales in the region.

What gets the credit for Nokia’s success? Budget phones like the Lumia 520, says Kantar, which have become something of a gateway device for new smartphone owners.

“Nokia has continued its successful tactic of sucking up remaining featurephone owners across Europe,” writes Sunnebo. “Even in Britain, where smartphone penetration is at 70%, there are over 14 million featurephone consumers for it to target. At some point Nokia will have to start making serious inroads into the smartphone competition, but for the time being its strategy in Europe is working. Crucial for Nokia will be its ability to keep low-end owners loyal and upgrade them to mid to high-end models.”

But just as low-end is one entry point, so are certain form factors. In China, where handsets and tablets are rapidly taking the place of PCs as a consumer’ main internet device, Kantar says that “phablets” with screens larger than five inches accounted for 31% of all sales in the last three months. Screens bigger than 5.5% took 9% of sales.

Sunnebo says that China is a standout in this regard. “Phablet sales across Europe and US have been gradually rising, but it’s China which is driving demand,” he writes. “Phablet owners are less likely than the average consumer to own a tablet, indicating that phablets are increasingly being used as the primary device to browse online in China.”

Just as colorful 5c handsets have apparently caught the eye of female consumers, phablets are also skewing “heavily to women” in China.

But it remains to be seen whether the phablet is here to stay. “It’s too early to forecast the long-term trends for China, but in Europe where the first wave of phablet owners are now coming to upgrade, over 40% are down-sizing to a smaller device,” writes Sunnebo.

Photo: Flickr