When Facebook mentioned “a decrease in daily users specifically among younger teens” in last quarter’s earnings call, its share price fell from $57.98 in after-hours trading to open the next day at $47.16, eliminating tens of billions of dollars in value accrued from strong financials. How will investors react if today’s Q4 2013 earnings see Facebook admit a more serious decline amongst youngsters?

It’s a grim question considering that despite security breaches, Snapchat seems to still be growing strong with teens. Meanwhile, international messaging apps popular with kids appear to have maintained their momentum. It’s critical to understand that these competitors aren’t going to replace Facebook. They’re discrete apps that perform a very specific messaging function. Facebook is a full-fledged social network and identity provider. The threat isn’t Snapchat or WhatsApp destroying Facebook the way Facebook destroyed Myspace, it’s them stealing monetizable time away from Mark Zuckerberg’s creation.

Still, Facebook may need a lot of other bright spots in today’s earnings to outshine issues with teens, who are seen as social network trendsetters.

Still, Facebook may need a lot of other bright spots in today’s earnings to outshine issues with teens, who are seen as social network trendsetters.

One milestone its likely to benefit from is that Facebook is almost sure to cross the 50% mark in terms of percentage of ad revenue coming from mobile. It hit 49% in Q3, up from 41% in Q2, so we might see it reach around 53% today. Wall Street expects revenue of $2.35 billion and $0.27 EPS but Facebook may need more to impress investors. Shares opened at $54.61 today, well over double its 52 week low of $22.67 and May 2012 IPO price of $38, but down a bit from a high of $59.31 earlier this month.

Facebook also may be reaching saturation in its top markets like the US and UK, and slow growth or declining total user counts there could spook the street.

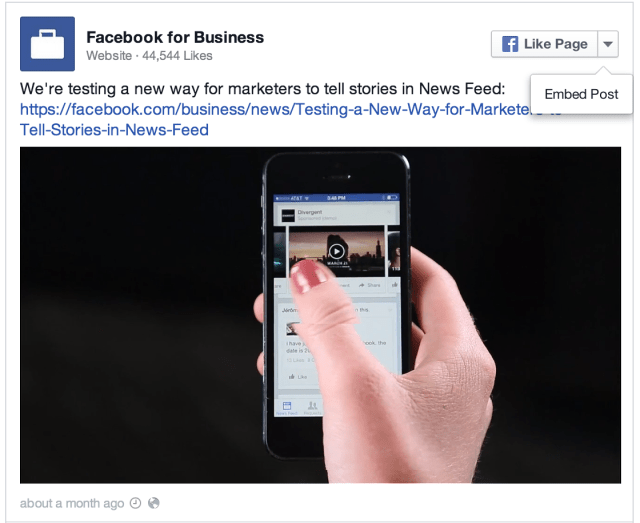

The financial spotlight will be on the success or failure of Facebook’s newest ad products: Instagram ads and Facebook auto-play video ads.

Facebook described the early results of Instagram ads that began appearing November 1st as “promising” in December, yet there’s still worry that backlash about marketers invading Instagram could turn off users.

Silent auto-play video ads only began showing up on Facebook in mid-December, so it’s likely too soon to expect serious revenue out of them, but analysts could press Facebook for early insights into their performance. The bulk of Facebook’s mobile ad revenue depends on its more mature mobile app install ads product that was the highlight of the first half of last year’s earnings reports. Now Facebook also has mobile app re-engagement ads and improved offline conversion tracking humming, which could give it a boost.

Product-wise, Facebook’s been in a bit of slump lately. Instagram Direct, its new private photo messaging feature, hasn’t seemed to be gaining significant traction. Even though my friends are active Instagrammers, I haven’t recieved a Direct message in over a month, and other TechCrunch writers haven’t either. My early prediction that Direct may fail because its wall-based group chat is too different from traditional messaging but not unique enough to capture attention is seeming more accurate.

Facebook never rolled out the News Feed redesign it announced last year, and Graph Search remains stuck on the web after a year despite claims it would go mobile in 2013.

The social network continues to fiddle with its feed algorithm in hopes of making it more informative and sticky, though it’s walking on egg shells trying to avoid pissing off Page owners by decreasing their organic reach. Facebook’s also taken to emulating Twitter.Trending topics, hashtags and more have earned it some jabs for not innovating, though Facebook’s take on Trending is more about providing descriptive, high-level takes on the day’s biggest headlines than following up-to-the-minute public reactions like on Twitter.

Facebook is soon expected to launch a visual-focused reimagining of the news reading experience we caught wind of last year, though. And it launched a strong makeover of its Messenger app that makes it quicker, more modern, and that uses cutesy design to distance it from Facebook’s more utilitarian core app. This could help it fend off mobile-first messaging competitors like WhatsApp, which now has a staggering 430 million users.

But if last quarter’s earnings call was any indications, just one word could make or break Facebook’s share price today: teens. The problem is that Facebook has a lot more to lose than to gain here. Even if it can reassure investors that kids aren’t leaving Facebook despite it not being “cool” any more, investors may simply reply “yet?” Whereas a full confession that teens are drifting away could trigger an investor panic about an incoming Facepocalypse.

For more news and up-to-the-minute coverage of Facebook’s earnings, click below:

Image: Shutterstock