Apple CEO Tim Cook today admitted that in its home market of North America, “we did not do as well…our business contracted year over year.” But to counterbalance that, the iPhone maker is pushing its international business. In the company’s Q1 2014 earnings, out earlier today, Apple says that international markets accounted for 64% of sales.

As a point of comparison, international accounted for 60% of sales in Q4.

Sales in Greater China and Japan, fuelled by Apple’s iPhone, have grown the most, respectively up 29% to $8.8 billion and 11% to $5 billion versus a year ago. The growth in these two countries specifically appears to be bolstered by a growing ecosystem in these markets: recent carrier deals with the largest players in each market, China Mobile and NTT DoCoMo, certainly helped, as did an early rollout of Apple’s newest iPhone 5 devices; but so does a strong content play. In China, Apple today said that developers have published some 130,000 apps in the App Store.

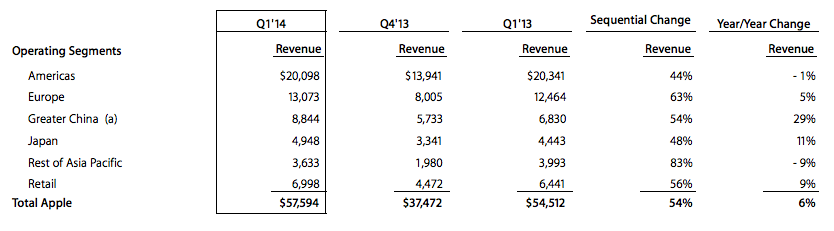

In the regional sales breakdown that Apple provided in its earnings, sales were down slightly in the Americas and Asia Pacific outside of Greater China and Japan over last year; the rest of the markets were up.

While Europe collectively is Apple’s second-largest market after the Americas, bringing in $13 billion of revenue in Q1, growth has slowed right down in the region: it was only up 5% compared to a year ago. If you look at Kantar Worldpanel’s sales estimates for the last quarter that were out earlier today, the reason for the decline appears to be squarely down to competition from Android, and in some cases Windows Phone, as Apple battles it out against Microsoft for second place.

The real international story for Apple right now seems to be in Asia and emerging markets.

We had an indication that the results China would be positive, when Tim Cook said in an interview in Beijing earlier this month that sales in China in Q1 were hitting a record for the company.

Today Cook fleshed that out a bit. “We’ve been selling with China Mobile for about a week…and it’s been an incredible start,” he said on the call today, referring to its sales in the country a “new high water mark.” The company is only in China Mobile stores in 16 cities in China today; it expects to be available in over 300 cities by the end of the year. Even so, mainland China had record iPhone sales in the quarter and saw doubled iPad growth.

Kantar Worldpanel’s figures, which Apple cited a couple of times in its earnings call, indicated that in Japan, Apple continues to wipe out the competition, taking some 69% of all smartphone sales.

Emerging markets

Apple has really not gone after a low-end device strategy compared to Android handset makers, but today the company set out to try to prove that this has not impacted its sales in emerging markets.

CFO Peter Oppenheimer said Apple was “very pleased with our performance in emerging markets,” a sentiment Cook brought up later, with some relative numbers to spell it out: in Russia (where it just inked a new deal with carrier Megafon) sales were up 115%; in Latin America (lumped together in ‘Americas’ with the declining/saturated North America market) they were up 65%; and the Middle East sales were up 20%.

Growth, of course, is more of a hopeful metric than actual sales, which Apple did not break out for these markets today. The big question is whether these international plays will help Apple continue to move the needle, and whether users in these markets will adopt Apple products as earnestly as consumers in the U.S., UK, Japan and other countries where Apple has proven to be a hit.