The nearly boozy Bitcoin rallies and crashes of 2013 led to endless media coverage, rising mass market knowledge of its existence, and piece by piece, the growing maturity of its underlying network.

No asset that regularly loses or gains 50% in a day can be treated as anything more than a speculative tool, and an incredibly risky one at that. However, in the new year, as the media firestorm has mostly abated around Bitcoin and its network of buyers and sellers has continued to improve and expand, something interesting has happened: Bitcoin has found and stuck to a trading range.

Now, compared to more traditional currencies, Bitcoin still moves around too much for the good digestion of those close to it. At the same time, over the past nearly two weeks, it has shown remarkable flatness, meaning that those wishing to use and accept it for commerce have had a period in which they could trust their sales and purchases to not swing to wild profit or loss by whim of the market.

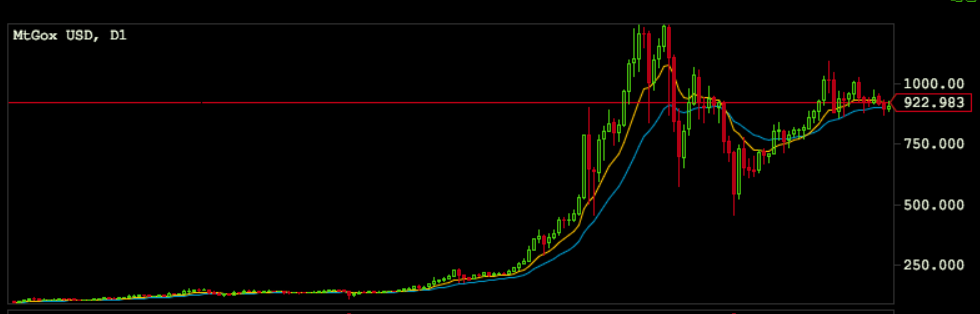

The Bitcoin D1 chart remains as humorous as ever (in this case, D1 means that every chart point represents one day’s trading):

But taking a look at an H4 chart of the recent history, and you will note that following the imposed vertical white axis, Bitcoin has essentially behaved itself. That marks shown is the 7th of January, past which Bitcoin has managed a real interval of lucidity:

Compare the preceding and following sections of that chart — it almost feels like we are looking at two difference substances.

Price stability has been a Bitcoin bugaboo for as long as you can recall because the rise in the currency’s value was often correlated to news stories regaling its surges. Upward momentum and all of that. But instead if Bitcoin was to become a medium of exchange more so than a store of speculative hype, it needed to calm down. This, as you have seen has, lead to a denouement of media coverage of Bitcoin, even from your humble servant.

If you’ll allow the indulgent self quote, this is what we are talking about:

Bitcoin needs a more stable price, which can only come to fruition after its network becomes large enough to have validated the price of Bitcoin at a certain level. And for that it needs to attract more retailers, which are kept out by its price swings.

This is all simple in summary: The utility of Bitcoin as a currency and its value as an equity depend on its network, which provides the market opportunities for Bitcoin to behave as either.

Right. And, as retailers such as Overstock.com have come on board, so too has Bitcoin fallen from the media’s eye and managed a decent run of stable pricing.

A change in the winds?

Top Image Credit: Flickr