Justin Kan launched Exec in early 2012 as an on-demand errand service for businesses, but over time, morphed into a cleaning service to focus on its most popular offering. Unable to scale “Errands” and struggling to find its legs, the startup folded its personal assistant service in September and later dropped prices for home cleanings in each of its nine markets.

Rumors of Exec’s trials have been swirling for several months now, as the startup found itself paddling upstream and competing against fast-growing services like Homejoy, MyClean and Handybook in an increasingly crowded on-demand cleaning market. Today, those rumors appear to have been confirmed as Exec has opted to join the ranks of a competitor, rather than go it alone. If you can’t beat ’em, join ’em, as they say.

After what co-founder and CEO Oisin Hanrahan called a “competitive bidding process between multiple companies and home services brands,” Handybook announced this morning that it had won out, completing an acquisition of Exec that will see the two on-demand home improvement and cleaning brands join forces.

In an equity deal valued at “less than $10 million,” according to the companies, Exec will continue to operate in its West Coast markets, but under the Handybook brand. Co-founders Justin Kan, Daniel Kan and Amir Ghazvinian will stay on in an advisory role — with Justin Kan providing “strategic counsel” — while Handybook co-founders Hanrahan and Umang Dua will continue as the chief officers of the new company.

But, given the competitiveness of the space, why was Handybook able to win the bidding for Exec? Of all the companies in the space, Hanrahan tells us, the chief reason Exec ended up going with Handybook was that it was able to offer the most potential synergies — especially in terms of marketshare.

Launched in June of 2012 to help people find better, trustworthy professionals to take care of their household needs, Handybook currently operates its on-demand cleaning and household services in 13 markets across the U.S. However, Handybook’s strongest markets have traditionally been on the East Coast and in the Mid-west, owing to the fact that it was founded (and is now headquartered) in New York.

In contrast, while Exec has been operating in nine markets since September, it’s penetration has been strongest on the West Coast, particularly in Los Angeles and San Francisco. By acquiring Exec, Hanrahan says that Handybook will now be able to bring its services to new communities and grow its footprint on the West Coast, where Exec currently serves the four largest cities in California — San Francisco, San Diego, Los Angeles and San Jose.

The acquisition enables Handybook to create a “brand with bi-coastal hubs,” he says, and leveraging Exec’s traction in its home territory, will allow Handybook to open its first Los Angeles office in Santa Monica later this year.

With an acquisition price reportedly less than $10 million, it’s not a big win for Exec, which has raised $3.3 million to date from investors like CrunchFund, SV Angel and Y Combinator. However, if Handybook is able to continue scaling at its current pace and grow into the market leader, the equity the Exec co-founders now have in Handybook could negate any loss incurred over the long run.

For Handybook, the Exec acquisition allows it to add a recognized brand to its ranks and significantly expand its footprint on the West Coast, enabling it to better compete with the fast-growing and well-funded Homejoy. The company expanded into five new cities in 2013 and launched a new version of its mobile app this fall, which gave the product much-needed compatibility with all iOS devices.

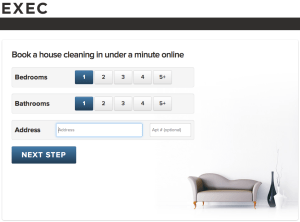

In short, the company’s web and mobile service aims to simplify the process of booking cleaning and repair services, trimming the process down to three steps. The user selects the service they’d like, confirms the time they want to cleaner or repairperson to arrive and then enters their email address.

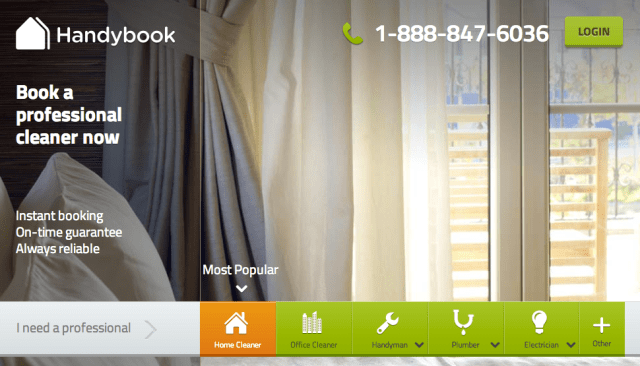

Like Homejoy and others, Handybook’s approach has been designed to capitalize on the growing demand for on-demand services — especially of the cleaning variety — along with the increasing facility people have with whipping out their mobile devices to look for, discover book and rate these types of home services. However, having initially launched as an on-demand personal assistant service, Handybook’s real appeal lies in its chief difference from the majority of startups in this space. Whereas many focus solely on cleaning, Handybook allows user to book a variety of home services.

Like Homejoy and others, Handybook’s approach has been designed to capitalize on the growing demand for on-demand services — especially of the cleaning variety — along with the increasing facility people have with whipping out their mobile devices to look for, discover book and rate these types of home services. However, having initially launched as an on-demand personal assistant service, Handybook’s real appeal lies in its chief difference from the majority of startups in this space. Whereas many focus solely on cleaning, Handybook allows user to book a variety of home services.

The startup offers both home and office cleaning along with the ability to book a handyman, plumber and electrician, but it also allows users to book unique requests across the home improvements category. And, while Exec never focused specifically on facilitating award-winning home improvements, its TaskRabbit-like origins make its founders and team potentially useful to Handybook as it looks to expand its on-demand service coverage.

While Exec founder Justin Kan said that cleaning had become “more impactful than its errands business revenue-wise after only a few months of operation” — and was accounting for 90 to 95 percent of usage when “Errands” was shut down — the latter was one of his favorite parts of the business.

However, “Errands” was something that users had to “work to use,” in that customers would have to get “creative to think up ways to save their own time by having someone else do something for them.” Moreover, beyond founders and engineering types, it was difficult for potential customers to get into that mindset, he tells us, and while people initially liked the idea, it didn’t stick.

But as for Handybook, Kan says that the conversations began about eight months ago and, initially for advice, but then, after seeing that they were “pretty far along on the user acquisition and business model sides,” they quickly began to consider an acquisition. On this process, Kan offered advice to founders, saying that it’s important for entrepreneurs to be honest with themselves and identify where their strengths lie — and what’s outside of their core competency.

“For us,” he said, “we believed we were doing a good job with Exec, but that the growth could be seriously accelerated if we joined Handybook.” In the end, when Kan and his co-founders had to “decide between trying to chase and replicate some of the things competitors had done or be acquired, the decision became clearer.”

Ultimately, although Kan is an investor in Homejoy as a seed investor at Y Combinator, he felt that Handybook was a better fit for Exec than the YC grad because it had “figured out cross-selling services,” he said. It’s a tough road to convince customers to not only buy cleanings from the phone or the Web, let alone convince them to book repair and electrical work, plumbing services and so on. In the end, Kan said, Handybook had that figured out better than the rest.

Handybook has raised $12 million in total funding to date, from General Catalyst Partners, Highland Capital Partners and TechStars co-founder David Tisch, among others. With Exec in tow, the startup now has to go out and live up to its promise of not just taking on competing cleaning services, but disrupting the home services industry and, potentially, giants like Angie’s List.