Flint Mobile, a mobile payments startup that, unlike Square or PayPal Here, uses the phone’s camera instead of a dongle to “scan” credit and debit cards, announced this morning an add-on in Series B funding from Verizon Investments, the investing arm of Verizon Communications. This brings Flint’s total Series B raise to date to $8 million.

The company had previously announced $6 million in Series B funding led by Digicel Group with SVG Partners, Storm Ventures, and True Ventures also participating. In 2012, it had raised $3 million, also from Storm and True Ventures.

The Verizon investment is interesting, given that Flint already saw funding from Digicel, a wireless service provider with networks across the Caribbean and the South Pacific. Though the company isn’t discussing its roadmap in detail, it would say that the additional funding from Verizon will help with continued product development and customer acquisition.

“Mobile operators seem to appreciate our unique focus to offer full mobility for businesses and are interested in pure digital app models to drive innovation and scale,” says Greg Goldfarb, co-founder and CEO of Flint Mobile. “Based on their day-in, day-out business operations, they see the distribution and adoption challenges posed by hardware accessories first hand,” he adds.

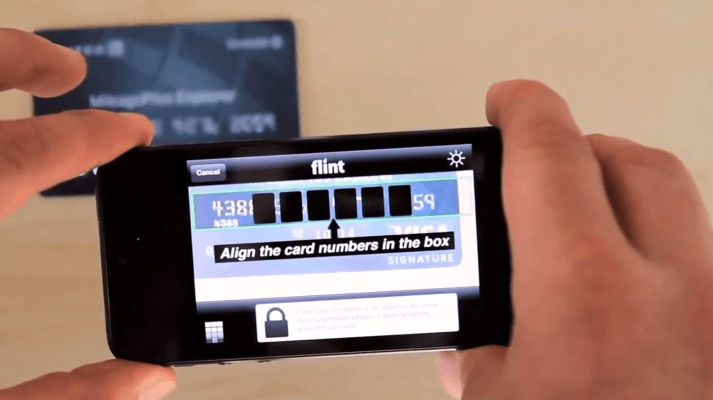

Like its dongle-based competition, Flint’s mobile payments application for both iOS and Android, is designed for use by merchants and other businesses that operate out of the traditional retail environment, but still need a way to process credit and debit card transactions, handle invoices, send out customer receipts and more. The company now goes a step further, allowing its business users to access cash and checks, too, in the latest release, also out today.

The update, arriving first for iOS users, allows merchants to send invoices to customers who can then pay online, from their mobile or tablet computer, without waiting for a check or bank transfer. Flint can also track overdue invoices, and send reminders.

Another new feature involves Apple’s Passbook. Flint merchants can now create customized coupons within the app or merchant portal, which can be emailed to customers who then add the coupons to Passbook. The feature is available at no extra charge. Merchants can later scan their Passbook coupons to redeem. Those customers without Passbook can instead redeem their coupons via a QR code received via email. And merchants can send out reminders to their customer base via email before coupons are set to expire.

Flint has been updated to handle multiple items, custom payment amounts, and the application of discounts to transactions, too.

Android users currently can take advantage of the invoicing option through the merchant portal online, but the other new features will arrive on the Android mobile platform in the near future, the company says.

The service is competitive on fees when compared with the competition. For example, while Square charges a reasonable 2.75 percent per swipe and PayPal Here is 2.7 percent, Flint reduces that to 1.95 percent for Visa and MasterCard debit transactions, then increases it to 2.95 percent for credit cards. However, the company doesn’t currently support AmEx and Discover, while others do.

In addition to its lower debit-card fees, Flint has aimed to differentiate itself by offering other features like its social marketing tools, which allow businesses to generate Facebook referrals via its emailed receipts where customers are invited to leave a review and like a Facebook page.

The company today has seen around 200,000 customer installs to date, the majority of which are on iOS, as Android was released just this October. That’s up from the 150,000 installs announced around the same time. Since Q1 2013, transaction volume has growth by 14x or more, according to Goldfarb, and the average transaction amount has consistently been around $100, which reflects its service-oriented merchant user base.

Customers on Flint tend to include beauty and fitness services, specialty contractors, photography and local media, healthcare services, pro services (consultants, attorneys, accountants, I.T. services), recreation and tour guides, and direct sales (Mary Kay, Scentsy, etc.) – businesses which are drawn to Flint, says Goldfarb, because there’s no need to acquire hardware in order to get started accepting transactions.