Nokia’s shareholders have approved the sale of its devices & services unit to Microsoft at an EGM held today in Helsinki, the FT reports. The transaction is still expected to close in the first quarter of next year (subject to regulatory approvals), with Nokia in a caretaker role of its own mobile making division until early 2014.

Update: Nokia has now confirmed the outcome of the shareholders’ vote in a press release, which notes that: “More than 99 % of the votes cast at the EGM were in favor of this proposal.”

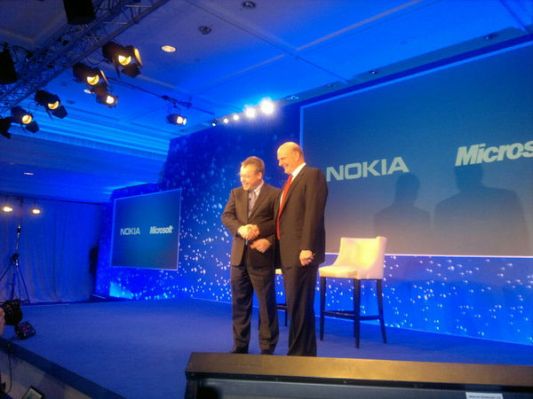

It’s the end of an era for Nokia. And also closes a recent chapter for the business which started when it appointed its first non-Finnish CEO, and also former Microsoft executive, Stephen Elop to the top job back in September 2010. Elop went on to forge a partnership with Microsoft over its Windows Phone OS, and ultimate sever ties with Nokia’s own software platforms. From that handshake, to today’s full stop.

The acquisition of Nokia’s mobile making division was announced at the start of September, with Microsoft agreeing to pay €5.44 billion ($7.2 billion) in cash to acquire “substantially all of Nokia’s Devices & Services business, license Nokia’s patents, and license and use Nokia’s mapping services”.

The Devices and Services portion of the acquisition accounts for €3.79 billion, with the patent licensing deal making up the remaining €1.65 billion, the pair said at the time. The news sent Nokia’s shares climbing steeply, and they’ve been tracking upwards since — with the stock roughly doubling since the deal with announced. Nokia chair Risto Siilasmaa made that point to shareholders at today’s EGM.

The shareholders had been expected to approve the deal, despite some rumblings of discontent among Finnish investors dismayed to see Nokia sell off what was formerly the jewel in the company crown — and indeed, for many years, in Finland’s crown — to a foreign company.

According to Times journalist Nic Fildes, tweeting from the EGM, the deal was a done-deal before the vote at the meeting with 99% of pre-registered shareholder votes (78%) voting to approve it. Elop was also apparently in attendance at the meeting, although he left the talking to Siilasmaa.

The sale will remove some 32,000 staff from Nokia’s payroll (and add them to Microsoft’s books), substantially shrinking Nokia’s headcount costs, as well as injecting some much-needed cash back into the remaining business. Up until recently Nokia was burning money via its loss-making mobile phones division. Indeed, its need for cash has seen it already pull on Microsoft’s purse, drawing down €1.5 billion ($2 billion) in convertible bonds from Redmond a few days after the deal was announced.

Despite hemorrhaging cash in recent years as its share of the smartphone market slumped from major to marginal, Nokia announced a surprise profit of €118 million in its Q3 earnings last month, swinging back from a €115 million loss last quarter, and a €564 million loss in the year ago quarter. If that was the beginning of a turnaround for its devices unit, it’s come too late for Nokia to hold onto it, however.

Post-devices, Nokia is concentrating its efforts on three business divisions: its networking business, NSN; its location services business, HERE; and a new business division called Advanced Technologies which encompasses its patent portfolio and also ongoing R&D efforts in areas such as sensing, connectivity, materials and web and cloud technologies.

Details of the terms of the deal with Microsoft, as set out by Nokia for its shareholders to consider ahead of today’s meeting, can be found here.

The key paragraphs detailing the transaction terms are as follows:

The purpose of the Extraordinary General Meeting is for you and our other shareholders to consider and vote on a proposal to confirm and approve the transactions contemplated by the Stock and Asset Purchase Agreement, dated as of September 2, 2013 (the “Purchase Agreement”), by and between Nokia Corporation and Microsoft International Holdings B.V. (“Microsoft International”), a wholly owned subsidiary of Microsoft Corporation (“Microsoft”). Under the Purchase Agreement, Nokia will sell substantially all of its Devices & Services business (the “D&S Business”), including assets and liabilities to the extent primarily related thereto, to Microsoft International (the transactions contemplated by the Purchase Agreement, the “Sale of the D&S Business”) for an aggregate purchase price of EUR 3.79 billion in cash, subject to certain adjustments.

Nokia has also entered into a mutual licensing agreement (the “Patent License Agreement”) with Microsoft that will become effective upon consummation of the Sale of the D&S Business and a payment to Nokia of EUR 1.55 billion, and, as consideration for Microsoft’s unilateral right to extend the term of the Patent License Agreement to perpetuity, an additional payment of EUR 100 million to Nokia. Under the Patent License Agreement, Nokia will grant Microsoft a 10-year license to certain of Nokia’s patents and Microsoft will grant Nokia reciprocal rights to certain of Microsoft’s patents for use in Nokia’s HERE business. Upon consummation of the Sale of the D&S Business, Microsoft will also become a strategic licensee of the HERE location platform and will pay Nokia separately for the services provided under this license. Microsoft is expected to become one of the top three customers of HERE. Nokia will retain the Nokia brand and all of its patents and patent applications worldwide, provided that certain registered design rights that are specific to the D&S Business will be included in the assets transferred to Microsoft.

The Sale of the D&S Business and the licensing arrangements described above are expected to be significantly accretive to Nokia’s earnings as each of Nokia’s continuing businesses, NSN, HERE and Advanced Technologies are global leaders in enabling mobility in their respective areas. The Sale of the D&S Business and the licensing arrangements described above are also expected to significantly strengthen Nokia’s financial position and provide a solid basis for future investment in the continuing businesses. During the first half of 2013, we estimate that the non-IFRS result of the business proposed to be sold, “substantially all of Devices & Services business” would have been a loss of EUR 395 million and net sales of that business would have been EUR 5.3 billion. For the same period of time (on a pro forma basis) the non-IFRS result of Nokia’s continuing businesses would have been a profit of EUR 436 million and the net sales of Nokia’s continuing businesses would have been EUR 6.3 billion. On a pro forma basis Nokia had EUR 12.8 billion of gross cash and EUR 7.5 billion of net cash at the end of the first half of 2013.