Dianping, the restaurant review platform that is sometimes referred to as the “Yelp of China,” turned down an acquisition offer from Google China in early 2007, co-founder Edward Long revealed at the TechCrunch/Technode event in Shanghai. Google China valued the company, which was then four years old, at less than $100 million. After Dianping refused its buyout offer, Google China made a Series B investment in the site of a few million dollars. Dianping’s other investors include Trust Bridge Partners, Sequoia Capital, QiMing Ventures and Lightspeed Venture Partners and it has raised almost $180 million in funding.

Long said Google China licensed its content for local search products. But then in 2010, Google pulled its search engine out of China, which Long says was a loss for Chinese consumers.

“If Google had stayed, Baidu wouldn’t have become so strong and it wouldn’t be able to charge so much for online advertising,” Long says, referring to China’s largest online search company, which now holds a 63% share of the market according to analytics firm CNZZ.

He added that large international companies like Google and Yahoo have had a hard time gaining a foothold in China because their massive size prevents them from localizing quickly enough.

Rumors that Dianping is gearing up for an exit in the near future are untrue, Long says. The ten-year-old restaurant review platform, which has more than 75 million monthly active users and 6 million merchants in 2,300 cities throughout Asia, recently denied reports that it is being courted by Baidu with an acquisition offer of $2 billion. Dianping CEO has said that the company wants to go public in five years with an estimated valuation of more than $10 billion, but Long refused to confirm that amount at the event.

In an interview after his panel, Long explained that he feels Internet companies shouldn’t go public until their market becomes more stable, because if a company issues too many quarterly forecasts that don’t pan out, it will quickly lose the faith of investors.

Dianping monetizes through a combination review and e-commerce model, selling membership cards and e-coupons, and analytics and data for restaurant owners. It plans to open a marketplace for offline services soon.

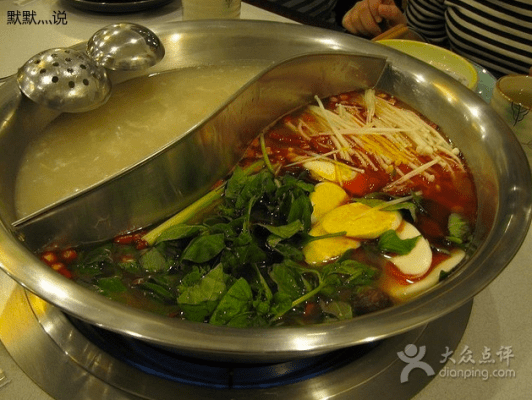

Image source: Dianping.com