Chinese Bitcoin exchange, BTC China — the world’s largest by trading volume according to Bitcoinity.org — has closed a $5 million Series A from institutional investors Lightspeed China Partners and Lightspeed Venture Partners. BTC China was bootstrapped prior to this round, with money put in by its three co-founders, Bobby Lee, Linke Yang, and Xiaoyu Huang.

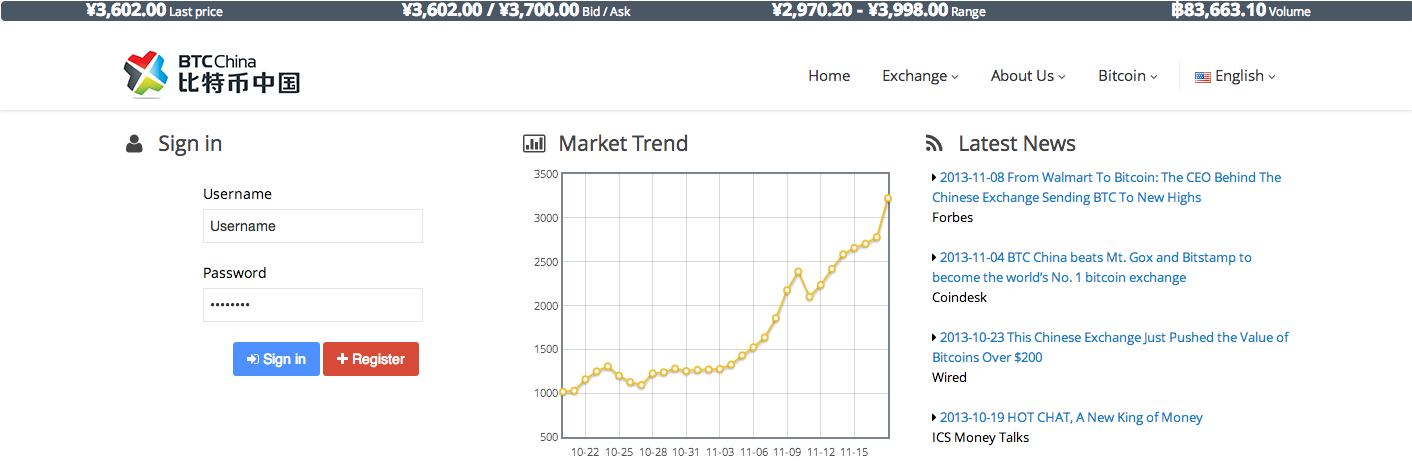

The exchange, China’s oldest, was founded back in June 2011. In recent times it has seen an influx of new investors crowding in as the hype around the decentralised digital cryptocurrency gathers greater momentum. The influx of Chinese investors has helped drive the value of Bitcoin to new heights — which, in turn, is attracting more investors. And resulting in continued cries of ‘Bitcoin Bubble!’

BTC China’s Lee, who is also the CEO, said it plans to use the new funding for “general operating expenses”, and to “aggressively grow and expand the business”.

“We are strong believers in the Bitcoin economy. Earlier this year we went out to raise funding. We knew this would happen — the Bitcoin economy would take off — there would be more attention paid to this space in China, and in the business and venture community. And sure enough everything we predicted is coming true. It’s a scary thought. It’s growing like a weed — so we’re aggressively expanding our team, our company, products & services,” he told TechCrunch.

In the past couple of weeks, BTC China’s trading volume has surpassed Japan’s Mt.Gox and Europe’s BitStamp, reaching 90,000 Bitcoins in daily trading volume, and more than 200 million CNY in daily transactions. Asked what he attributes BTC China’s growth to, Lee told TechCrunch he believes Chinese people are viewing Bitcoin as another (albeit, relatively new) asset class, and investing accordingly.

“China has been a nation of savers. Even though Bitcoin is new to the scene, we think it is a viable digital asset, so people have realized that and may be investing in it as any other asset class: stocks, bonds, gold, commodities, real estate, etc,” he said.

“I think for now, BTC China users are primarily buying Bitcoins for savings,” he added.

The influx of interest in Bitcoin in China was also discussed by Shakil Khan at last month’s TechCrunch Disrupt Europe conference. “Chinese television has been showing a number of short programs about Bitcoin,” he noted. “Let’s recognize that Chinese television is state-run television. So you start seeing the education process taking place there — and that’s been very good.”

Another boost to the currency in China has been attributed to more Internet companies in the country accepting payments made with Bitcoin — for example a division of Internet giant Baidu said it would accept Bitcoin payments for online security and firewall services in mid-October.

BTC China noted that several Chinese Internet companies are now accepting Bitcoin for payment — while, internationally, it said the figure runs to tens of thousands online merchants.

Commenting on the funding round in a statement, Lightspeed China Partners’ Managing Director and Co-Founder, Ron Cao, said: “The BTC China team is strong in terms of both technology and long-term vision. We think that under the leadership of the founding team, BTC China will continue to build out the Bitcoin ecosystem and bring more efficiency and value to the Chinese consumers, enterprises, and the overall financial services industry.”

“Bitcoin is igniting tremendous innovation in financial services around the world,” added Jeremy Liew, partner at Lightspeed Venture Partners, in another statement. “China is one of the areas where that innovation is happening fastest, which is why BTC China is now the biggest Bitcoin exchange in the world. Lightspeed is excited to support that innovation.”

BTC China’s Lee said he spoke to a number of VCs in Silicon Valley and China before the company settled on Lightspeed. “The reality is, when I went out fundraising earlier this year, I would say most of the VCs don’t get it. Most of the VCs don’t understand Bitcoin. They don’t understand the impact, the revolution and the disruptiveness of Bitcoin. And Lightspeed is one of the few VCs at the very top who really understand it,” he said.

Discussing the size of the Series A, Lee said that earlier in the summer, when the deal was being worked out, his view was that the funding would see BTC China through the next two to three years. However with the Bitcoin economy blowing up as it is in China he said it’s entirely feasible it may burn through that money quicker than originally expected.

“If we expand really aggressively, really fast we might be happy to go out to look for more funding sooner than two or three years,” he told TechCrunch. “It all depends on how the market evolves. We’re hiring very aggressively, we’ve put up budgets and all that but the reality is we’re growing at a much faster pace than I could even have imagined. Both growth in terms of usage and trading volume, as well as in the case of hiring.

“We’re at over 20 employees now. We’re fortunate to have been able to grow this fast and to cater to the demands of the Bitcoin ecosystem in China. So we’ll see. I can’t predict what’s going to happen in the future — how soon we’ll look for Series B funding. We’ll play it as it happens.”

Bitcoin is currently trading north of $500 on BTC China and at north of $600 on Japan’s Mt.Gox trading platform, previously the largest Bitcoin exchange before BTC China overtook it. Europe’s Bitstamp exchange also currently pegs the currency at over $500. Last month Bitcoin broke $200 for the second time — after another spike earlier in the year which was followed by a crash.

Asked about his personal view on the value of Bitcoin, in light of its huge increase in value in recent months, Lee said that in one sense the overall size of the Bitcoin market is still relatively small. The current circulation value of Bitcoin — calculated by multiplying the circa 12 million Bitcoins in circulation by a currency valuation of around $600 — works out at around $7 billion.

“Not too long ago we just crossed $2 billion. Now we’re at $7 billion. But if you look at that reality, $7 billion really isn’t all that much… compared to the price of gold. Gold on average, if you take all the gold above the ground, you divide it by the whole of the human population — seven billion — that comes out to about $1,000 per person for gold. So you take the market value of Bitcoin, you divide it by $1,000 — so that’s only seven million people so Bitcoin is a thousandths of the value of gold,” he said.

“The sky’s the limit in some sense. The price eventually will settle down, when there’s a good balance between supply and demand but clearly as more people are learning about Bitcoin, all that means is more people are becoming aware of it and as they become aware they become comfortable buying some Bitcoin. A few hundred dollars or a few dollars. But everything adds to the push up in price.”