Another startup is throwing its hat into the money transfer ring. Lithuanian-based TransferGo, which is currently part of the London fintech accelerator Level 39, is launching officially in the UK today, having been up and running in Lithuania and the Baltics following its 2012 launch.

The startup is also announcing that it’s topped up its seed round. Baltics-based early-stage investor Practica Seed Capital has added a further €200,000 to the startup’s bank balance, following an earlier investment it made of €150,000 — money the company says it’s using to expand to the UK and launch in others markets in the future.

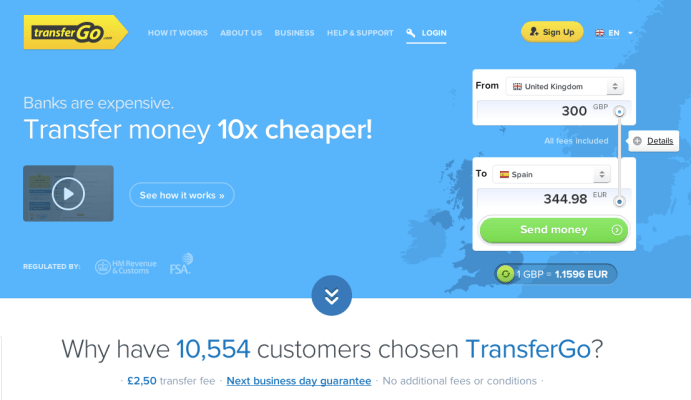

The startup is targeting consumers and businesses who want to transfer money from the UK to one of its eleven currently supported European destinations and, like competitors such as Transferwise and Azimo, promises a much reduced money transfer rate compared to those traditionally offered by the banks or incumbent money transfer services such as Western Union or Moneybookers.

Talking a good game, TransferGo also claims to trump competitors specifically on “next day” bank-to-bank transfers for those users who need to move money fast. Its guaranteed next day transfer is priced at £2.50, something the company is able to offer because, it says, it uses its own infrastructure, rather than going through a third party.

To date, TransferGo says it’s seen £3 million transferred via its service, with £1.5 million transferring in September alone. It claims “over’ 10,000 users, citing typical customer profiles as a parent sending money to support their families back home, foreign students transferring money for UK tuition, to businesses paying offshore invoices.

In that sense it really is competing with the much, much better funded and bigger Transferwise, and, specifically for consumers sending money to their countries of origin, Azimo. The key difference with Azimo, of course, is that money transfers can go to physical collection points, making it more of a Western Union competitor, rather than just the banks.

Meanwhile, to put the young TransferGo’s metrics into context, earlier this month Transferwise announced that it has processed £250 million worth of transfers through its platform since it launched in early 2011, up from £125 million in four months, and is now transferring more than £1 million a day.