Splat. That’s the sound the PC market just made. According to Sterne Agee analyst Vijay Rakesh, back-to-school computer sales were “virtually absent.” Put in other words: The traditional September bump that students provided to PC OEMs as they headed back to classrooms failed to generate a meaningful sales delta.

It’s like missing spring for the larger PC market.

The best way to view this news is that consumers are repudiating traditional PC form factors (desktops and laptops) for other devices at a quicker pace than expected – see the first few quarters of 2013’s stunning decline in unit volume – and that among younger folks (students for example), the trend has accelerated.

What hardware does the Windows-OEM community have in place to combat the market shift? That thundering silence you just felt is music in Cupertino and Mountain View.

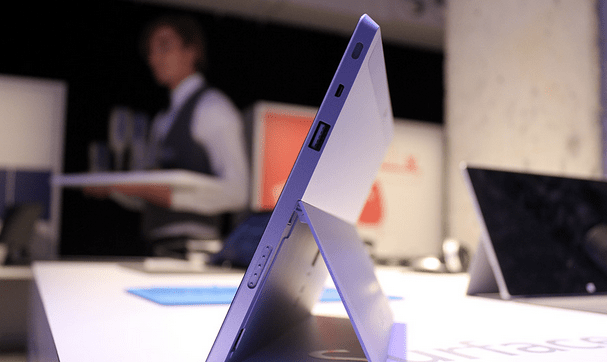

You probably had at least guessed at all of that. The kicker is that Microsoft is the only PC OEM that is selling a device that transcends the traditional PC OEM market. The Surface tablet lineup has never fit cleanly into any product category, period.

If consumers – students, especially – are moving away from laptops and desktops at a faster pace than we expected, they still have to produce. Given that, they will need a device that meets that need and satisfies their desire for mobility and touch. The Surface 2 could be that device.

At least in my view, there is no tablet quite like the Surface 2 in terms of its focus, capabilities (Office, Touch Covers, etc.) and price point. The new Touch Covers are too expensive, but the cheaper first generation Touch Covers fill that void somewhat.

Don’t get too excited, though; the Surface line still has a weight around its neck by the name of Windows. Windows 8 was one cause of weak first-generation Surface sales. Windows 8.1 is a material improvement on its predecessor. Whether it can work through the now year-old legacy of Windows 8 isn’t clear.

Summing briefly: Students appear to have forgotten to show up and buy new PCs for the school year. This underscores rapid transformation in their computing desires. Still, everyone has to get work done one way or another, and Microsoft’s Surface line might have backed into a market trend that can be harnessed to its advantage. The Windows 8.1 question remains open, but Microsoft could have built the device with the largest chance to bring back wayward sons and daughters to the Realm of Windows.

The sales will tell the tale. Microsoft has promised to break out Surface revenue each quarter, so we’ll know by the end of the year if Microsoft’s entrance into the OEM wars will grow the pie, or merely fight for a slice as the desert shrinks around it.

—

There is a bit of Come To Jesus for Microsoft’s hardware hopes in the next 12 months. The Surface 2 and Surface Pro 2 need to put points on the board to illustrate that project’s first financial year in the market was more growing pains than an indicator of market indifference and failed internal forecasting. The Nokia smartphone division needs to continue growing the Windows Phone market, as its unit volume is roughly 90 percent of the platform’s aggregate total. Microsoft will own that asset in early 2014.

I’d say that by this time next year, we’ll have a good handle on whether the devices side of Microsoft’s business transformation can reach the volume and revenue marks needed to be meaningful to the company’s future profits.

That’s in keeping with the Ballmer Rule: “The ultimate measure has to be what happens with profits. It’s got to be the ultimate measure of any company.”