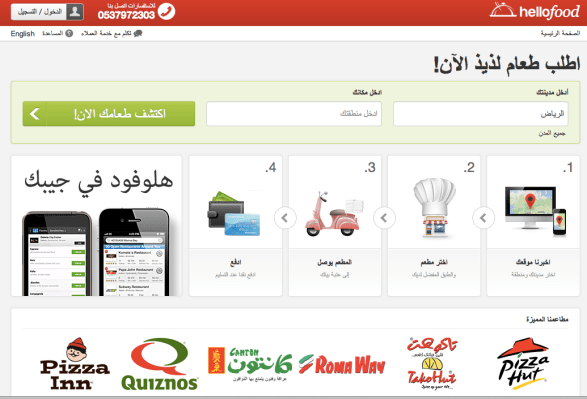

Rocket Internet, the Samwer brothers’ Germany-based e-commerce startup factory, has announced that it’s brought iMENA Holdings on as a partner and investor in Foodpanda’s Hellofood Middle Eastern operation. Specifically, iMENA is investing $8 million in the online take-out ordering service — capital that will be used to expand the service in the region, beyond Saudi Arabia where it currently operates locally.

The hook up between Rocket and iMENA to help Hellofood grow in the Middle East, billed as a strategic investment and partnership, is interesting since they have parallels. In fact, part of iMENA’s mission is to build new online businesses “based on successful and proven business models in other developed and emerging online markets” — if that doesn’t have at least a whiff of the Samwers’ strategy then I don’t know what does.

Regarding the investment in Hellofood ME, both parties are talking up the opportunities in the region, noting that its becoming an increasingly important market and one that is seeing a lot of startup and investment activity at the moment. The opportunity in the Middle East for Hellofood is something they feel by joining forces they can take advantage of and at a much greater pace. “With the partnership in place, restaurants across the region will have the opportunity to benefit from the growth of the consumer online industry through the global and regional support of two leading investors, developers, and operators of leading online businesses with a wide reach and significant resources to support the growth of their businesses,” the two companies said in a joint statement.

It’s also a further sign of Rocket Internet stepping on the gas with regards to Foodpanda/Hellofood. As recently as May, the online delivery startup raised more than $20m from a group of investors, including Investment AB Kinnevik and Phenomen Ventures. Money it is using to take the fight to its main competitors Delivery Hero, and Just-Eat, none of which appear to have a presence in the Middle East yet.

However, both are extremely well-funded, and have recently raised more funding: $50 million for Delivery Hero and $64 million for Just-Eat. Another potential competitor is GrubHub in the U.S., which is also not short of capital. As my colleague Ingrid noted, the funding race is a sign of how, in this market of a lot of me-too players, getting critical mass and a technological edge over competitors will be key to longer-term survival and profit.