FeeX, which helps users save on hidden retirement fees, has raised $3 million in Series A funding from Blumberg Capital. Co-founded by Uri Levine from Google-acquired Waze, the startup aims to raise awareness of excessive fees through its crowdsourcing platform. The funding will go towards the company’s U.S. launch in early 2014.

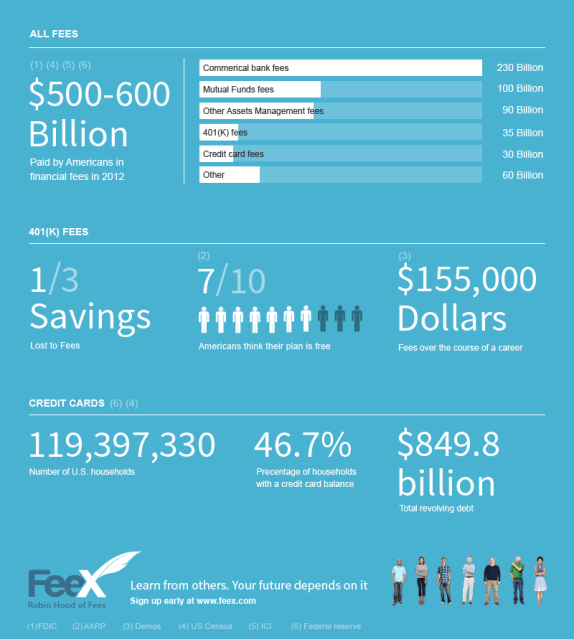

Retirement fees in America could add up to anywhere from $30 billion to $60 billion total per year, but according to a 2011 AARP study, seven in 10 Americans are not aware of the fees charged to maintain their 401(k) accounts. Many workers also lack a frame of reference to find other options. FeeX co-founder and CEO Yoav Zurel tells me that by accumulating retirement fee information with FeeX, users can compare what they are paying to others with comparable accounts.

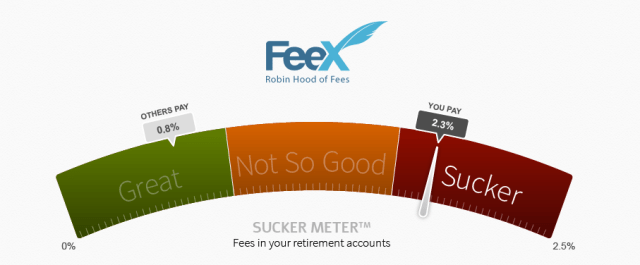

FeeX shows you the real accounts of others with similar financial characteristics. For example, it might show you users in similar employment or who have invested the same amount in their 401(k) plans. After linking up your own account, the platform places you on a “Sucker Meter” based on how much you pay in extra fees. After seeing the comparison, users can either confront their current companies about lowering fees or switch to a different company.

In order to use FeeX, users have to connect their personal retirement accounts, which may be a deterrent for potential users. To protect privacy, Zurel tells me, all online accounts are completely anonymous. Others can only view how much each account is paying, without viewing names, social security numbers or other sensitive information. With more than 6,500 users in Israel, Zurel says privacy has not been an issue for most people.

There are already several online tools that help manage 401(k) plans, such as Personal Capital and FutureAdvisor. FeeX works by drawing information through crowd sourcing, which users find more trustworthy, Zurel tells me. He also says FeeX differs from many financial advisors and aggregators by being objective, because the service doesn’t take cuts from financial institutions.

“Most of the platforms use a lead generation business model, which basically means you move from one financial institution to another and the platform will get a sales fee. So immediately when someone uses this kind of model, it is not objective,” Zurel tells me. “We have no financial relationship with any financial institution.”

FeeX is free right now, but Zurel says the company is looking to monetize through small and medium businesses. FeeX will provide services for 401(k) and 403(b) plans first, then expand to credit card fees, loan fees and more.