“Democratizing venture capital” sounds great until equity crowdfunding fills startup financing rounds with amateur angels who don’t add value. So while other funding platforms open the floodgates to any accredited investor, and eventually anyone if the JOBS Act goes into full effect, FundersClub will now only accept investors who’ve been invited by existing members or applied for an invite.

FundersClub was a pioneer in the equity crowdfunding space when it launched a year ago. The company acts as an online VC that vets startups looking to raise money, secures space in their upcoming funding round, and then lets its members invest money to fill up the space. The idea is not to replace traditional expert venture capitalists, but augment them with a crowd of evangelists, recruiters and connectors.

Since it was founded, the Y Combinator-accelerated FundersClub has raised $6.5 million for itself. It has also collected $7.2 million for its 31 portfolio companies from its crowd of 6,700 investors.

But since it launched, several other equity crowdfunding platforms have gotten off the ground, including Wefunder, while Circleup and AngelList have gotten more serious about the space. Meanwhile, the Securities and Exchange Commission recently voted to implement part of the JOBS Act and remove the ban on general solicitation. This allows startups, and platforms like FundersClub, to openly advertise that they or companies they work with are looking for investment.

Competing crowdfunding platforms are now trying to grow their investor member base. But in doing so, they threaten to let in people who don’t have much to offer startups beyond their money. The potential for equity crowdfunders to only provide this “dumb money” is a key talking point of traditional VCs that compete with them. Experienced entrepreneurs, engineers, recruiters, marketers, and testers can all provide value, but a random accountant with enough personal wealth to be considered an accredited investor might not be worth bringing in as an investor.

FundersClub CEO Alexander Mittal tells me his platform’s members are usually veterans of the startup ecosystem, including C-level executives and managers who can bring a lot to companies they fund. “We realized we had a special community we got out there first,” Mittal says, and he wants to keep that community elite so startups want FundersClub in their rounds.

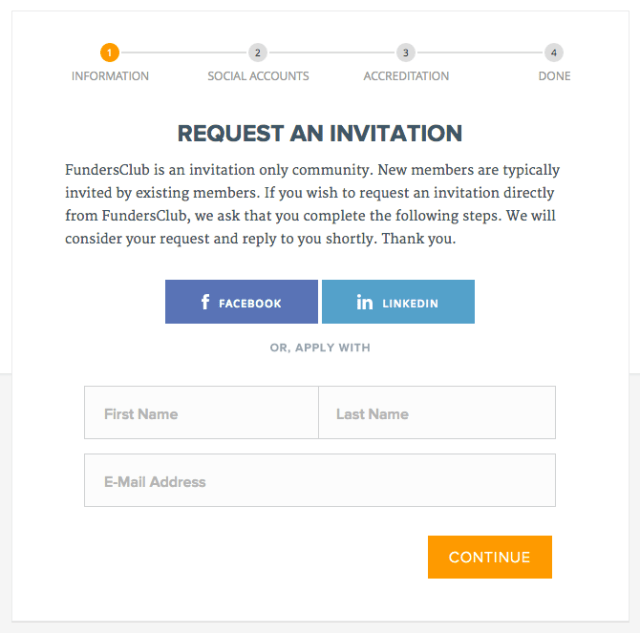

All existing FundersClub members won’t have to be re-vetted, but any new members will need an invitation from a member or request an invite from one and be approved. That should help the community grow organically and stay top of its class. The friction could deter some potential investors, but at the very least it will differentiate the platform.

The invite-only system could become even more important if the true crowdfunding part of the JOBS Act is implemented. This would let anyone invest, and not just accredited investors with more than $1 million in personal wealth. That could bring in even dumber money if funding platforms aren’t careful.

Mittal concludes, “People are getting loud, so we’re starting to speak softly while carrying a big stick.”