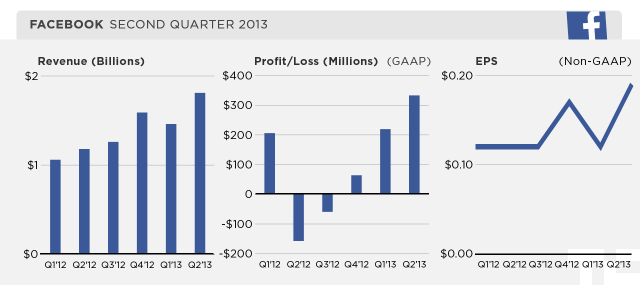

Today Facebook reported its second-quarter financial performance, including revenue of $1.81 billion. Analysts had expected Facebook to earn $0.14 per share on a top line of $1.62 billion. The company’s revenue figure released today is an all time quarterly high for the firm.

Facebook’s second-quarter revenue is up 53 percent on a year-over-year basis. Analysts had expected a 37 percent increase. In the quarter, Facebook had a net income of $333 million. In its most recent sequential quarter, the first of 2013, Facebook’s revenue totaled $1.46 billion, and it earned $0.12 per share.

Mobile income as a percentage of ad revenue totaled 41 percent, up 11 percent from the preceding quarter, when it totaled 30 percent. In the final quarter of 2012, mobile ad income was but 24 percent of the total advertising top line. Facebook has proven that it can monetize its growing mobile usage in a big way. Investors will be satiated in that concern.

Facebook later noted that mobile revenue will soon outstrip desktop incomes. The company also reaffirmed that Instagram will monetize in the future, largely through advertisements.

Frankly, in my view the 41% figure is quite impressive, and unexpectedly strong. However, we should not take as indicative that all desktop Internet giants will be able to monetize at similar levels in mobile settings. Facebook data on its users is nearly without compare, and likely provides it with a key competitive advantage in how it can deliver targeted ads to users on the go.

The majority of Facebook’s revenue comes from advertising-related income. However, its payments and fee revenue totaled $214 million during the quarter, up 11 percent on a year-over-year basis.

On the usage front, Facebook demonstrated strong growth, with its daily active user tally rising 27 percent on a yearly basis to 699 million. Monthly active users now total 1.15 billion for Facebook, up 21 percent when compared to the second quarter of 2012. Finally, mobile monthly active users were up 51 percent compared to 2012, to 819 million. For more on Facebook’s usage metrics, TechCrunch’s Josh Constine has the fully skinny.

Facebook’s capital expenses were down in the quarter, but it continues to suffer from margin pressure. In the second quarter, Facebook’s operating margin was 31 percent.

During the company’s earnings call, Facebook’s CEO Mark Zuckerberg stated that teen engagement remains quite high on the social service. According to the company, engagement among teens in the United States, penetration is all but complete, and engagement remains strong. That is against the narrative that teens are increasingly bored with Facebook, in favor of other services.

Facebook ended the quarter with $10.3 billion in cash and short-term investments, leaving it very well capitalized. In regular trading Facebook was up around 1 percent. In after-hours trading, Facebook is massively up.

Top Image Credit: Emmanuel Huybrechts